E&P | Infrastructure | International | Markets | NGI All News Access | Oil

U.S. Oil Output Flat; OPEC-Plus Sticks to Modest Production Plan Even as Ukraine War Rages

Despite solid demand and a raging war in Ukraine that could disrupt global supply, U.S. crude producers held the line on output in the final week of February – as they did throughout the month, the Energy Information Administration (EIA) said Wednesday.

Production last week was flat with the three prior weeks at 11.6 million b/d, EIA’s latest Weekly Petroleum Status Report showed. This reflected in large measure publicly traded producers’ collective decision to hold steady amid investors’ calls to divert investments away from fossil fuels.

On the same day, members of OPEC and an allied group of producers led by Russia – OPEC-plus – agreed to further boost output by a modest 400,000 b/d in March. This would continue a targeted rate of monthly supply increases launched in August 2021 to gradually unwind production cuts of nearly 10 million b/d made in April 2020 amid the pandemic.

The cartel’s decision comes amid Russia’s escalating war with Ukraine. With bombing and combat intensifying across Ukraine and sanctions mounting against Russia, analysts said oil supplies, already struggling to catch up with demand, could shrink. The concern is that Russia, a major producer, may lose its ability to export much of its crude as western countries pile punishments atop the Kremlin-controlled Russian economy and financial system.

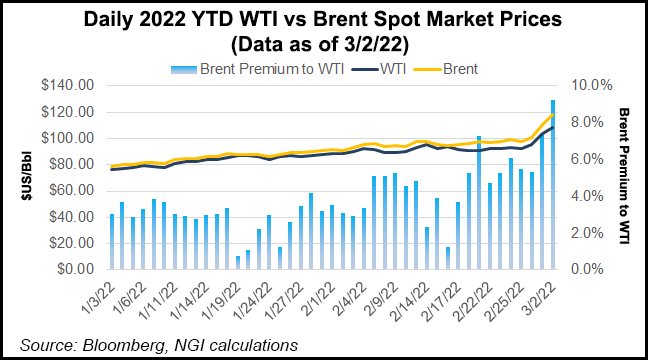

Brent crude, the international oil price benchmark, hovered near $110/bbl on Wednesday – up nearly 40% from the start of 2022.

“Investors, traders and politicians alike are scrambling to address the worsening Russia-Ukraine standoff,” said Rystad Energy’s Louise Dickson, senior analyst. “The current realistic scenario is that a large portion of Russian crude oil, as well as refined oil products, will no longer be palpable to the market and create a supply deficit for the duration of the armed conflict.”

Sen. Edward Markey, a Democrat of Massachusetts, this week introduced legislation to ban imports of Russian crude, noting that the United States last year imported 198 million b/d of crude and 354 million b/d of unfinished oils from Russia – about 8% of total U.S. imports.

Against that backdrop, ClearView Energy Partners LLC analysts said that, absent a surge in either U.S. or OPEC-plus output, supply challenges could prove lasting.

“We see a risk horizon of enduringly short supply and potentially long conflict,” the ClearView analysts said. “…Russia’s invasion of Ukraine demolished decades of diplomatic architecture in a matter of days. The global disorder left in its wake could persist for years.”

And as long as sanctions remain in place, “the world could be facing staggering supply risks, because Russia can dig a bigger hole in supply than strategic reserves or global spare capacity can sustainably fill in,” the ClearView analysts said.

American oil imports averaged 5.8 million b/d last week, down by 1.1 million b/d from the previous week, EIA said.

U.S. commercial crude inventories, excluding those in the Strategic Petroleum Reserve (SPR), decreased by 2.6 million bbl week/week, according to EIA. At 413.4 million bbl, stocks were 12% below the five-year average, the widest gap to date this year.

Total domestic petroleum demand, meanwhile, averaged 21.7 million b/d over the past four weeks, up 11% from the same period last year. Consumption of motor gasoline, distillates and jet fuels were all up notably – as they have been for months, pressuring balances.

Earlier this week, the International Energy Agency said it would release 60 million bbl of reserves to counter disruptions imposed by fallout from Russia’s invasion of Ukraine. The United States said 30 million of that total would come from the SPR.

“America will lead that effort…and we stand ready to do more if necessary, unified with our allies. These steps will help blunt gas prices here at home,” President Biden said during his State of the Union speech Tuesday night.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |