International | E&P | Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report | Shale Daily

BP Dumps Stake in Russia’s Rosneft Amid War in Ukraine; Shell Follows Suit, to Ditch NS2 Gas Pipeline

Citing Russia’s invasion of Ukraine, British energy giant BP plc said Sunday it would unload its stake in Russian government-controlled oil company Rosneft.

Other majors followed suit Monday, including Shell plc, which said it would exit its joint ventures (JV) with Russia’s Gazprom, the state-controlled energy giant behind the Nord Stream 2 natural gas (NS2) pipeline.

Equinor ASA on Monday also said it would end new investments and exit JVs in Russia. Like Shell, Equinor – the energy giant majority owned by the Norwegian state – called Russia’s attacks on Ukraine unjustified and said they necessitated drastic steps to create distance from the Kremlin.

Markets were watching closely for announcements from other major oil and gas firms with holdings in Russian energy projects, including the United States’ ExxonMobil and France’s TotalEnergies.

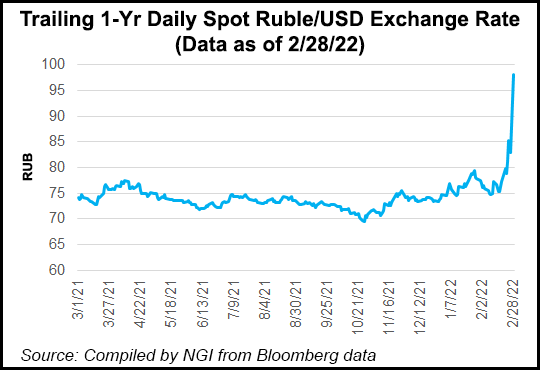

Russia’s currency, the ruble, dropped as much as 30% Monday, sparking severe inflationary concerns and forcing the country’s central bank to double its benchmark interest rate to 20%. Observers said Western sanctions, coupled with corporations withdrawing from Russia, could plunge the country’s economy into a steep recession with dwindling tools to draw upon in order to recover.

The United States sanctioned NS2 amid a slew of mounting Western government punishments, including closing airspace to Russian aircraft and shutting out leading Russian banks from a key global financial network.

The war also provoked fears of energy disruption that could further compress already tight global natural gas and oil supply/demand balances.

Oil and natural gas prices surged Monday as the United States and European allies imposed the sanctions on Russia. Brent crude for April delivery closed above $100/bbl. British and Dutch natural gas futures were also up, while Asian liquefied natural gas (LNG) spot prices followed them higher.

The benchmark Dutch Title Transfer Facility hit an intraday high of more than $42/MMBtu on Monday as concerns about European gas shortages deepened, given the sanctions and elevated uncertainty surrounding NS2.

In the United States, meanwhile, natural gas futures traded in a narrow range Monday as the market weighed uncertainties surrounding the war. The April Nymex gas futures contract settled at $4.402, down 6.8 cents day/day.

“Until Russia withdraws – not just a ceasefire – I think the Russian economy is going to take one beating after the next,” Samco Capital Markets’ Jacob Thompson, a managing director, told NGI. “Energy, especially, is a huge blow to Russia because of its dependence on oil and gas. These companies pulling out, that does create uncertainty and challenges in other countries, creates volatility in prices, but Russia will feel the most pain.”

BP Cuts TIes to Russia

BP is offloading its 19.75% stake in Rosneft. The company also said that both its CEO, Bernard Looney, and former chief executive Bob Dudley resigned on Sunday from Rosneft’s board of directors, effective immediately.

BP “has operated in Russia for over 30 years, working with brilliant Russian colleagues. However, this military action represents a fundamental change,” BP’s chair, Helge Lund, said in announcing the actions on the company’s website. BP added that it will no longer report reserves, production or profit for Rosneft.

“It has led the BP board to conclude, after a thorough process, that our involvement with Rosneft, a state-owned enterprise, simply cannot continue,” Lund added. “We can no longer support BP representatives holding a role on the Rosneft board. The Rosneft holding is no longer aligned with BP’s business and strategy and it is now the board’s decision to exit BP’s shareholding in Rosneft.”

Russia’s invasion, missile and airstrikes on Ukraine – along with cyberattacks – elicited condemnations across the global energy sector and from governments throughout the West, including the United States. U.S. and European sanctions against Russia and its leaders have since mounted along with Russian’s ground incursion pushing into Ukraine’s capital and other major cities.

The decision followed mounting pressure from the British government in the days since Russia launched the invasion of Ukraine on Thursday. British officials had accused Rosneft of supporting Russia’s attacks on its eastern European neighbor, according to The Wall Street Journal.

“Like so many, I have been deeply shocked and saddened by the situation unfolding in Ukraine, and my heart goes out to everyone affected. It has caused us to fundamentally rethink BP’s position with Rosneft,” Looney said on Sunday.

“I am convinced that the decisions we have taken as a board are not only the right thing to do, but are also in the long-term interests of BP,” Looney added. “Our immediate priority is caring for our great people in the region and we will do our utmost to support them. We are also looking at how BP can support the wider humanitarian effort.”

BP said the resignations would require it to change its accounting treatment of its Rosneft shareholding and, as a result, it expects to report a material non-cash charge with its first quarter results, to be reported in May. It could write down up to $25 billion following the exit.

Shell Withdraws from NS2

Shell’s board on Monday said it would end its involvement in NS2, which would deliver gas from Russia to Europe.

“Shell is one of five energy companies which have each committed to provide financing and guarantees for up to 10% of the estimated…total cost of the project,” the company said.

Shell also is exiting its joint ventures (JV) with Gazprom and related entities, including its 27.5% stake in the Sakhalin-II liquefied natural gas (LNG) facility, its 50% stake in the Salym Petroleum Development and the Gydan energy venture.

“We are shocked by the loss of life in Ukraine, which we deplore, resulting from a senseless act of military aggression which threatens European security,” said Shell CEO Ben van Beurden.

Shell’s staff in Ukraine and other countries have been working together to manage the company’s local response to the crisis. Shell said it also would work with aid partners and humanitarian agencies to help in the relief effort.

“Our decision to exit is one we take with conviction,” said van Beurden. “We cannot – and we will not – stand by. Our immediate focus is the safety of our people in Ukraine and supporting our people in Russia.

“In discussion with governments around the world, we will also work through the detailed business implications, including the importance of secure energy supplies to Europe and other markets, in compliance with relevant sanctions.”

At the end of 2021, Shell had around $3 billion in noncurrent assets in Russian ventures.

“We expect that the decision to start the process of exiting joint ventures with Gazprom and related entities will impact the book value of Shell’s Russia assets and lead to impairments,” executives said.

Shell said its “strategy and financial framework remain unchanged.” It still plans to distribute 20-30% of cash flow from operations via dividends and share buybacks.

“We stepped up our distributions by announcing an $8.5 billion share buyback program for the first half of 2022, and we expect to increase our dividend per share by 4% for the first quarter of 2022.

In 2021, Shell’s adjusted earnings from Sakhalin Energy JV and Salym JV were $700 million.

Shell has a 27.5% interest in Sakhalin-2, the JV with Gazprom, an integrated oil and gas project on Sakhalin island. Other ownership interests are Gazprom 50%, Mitsui 12.5% and Mitsubishi 10%.

Shell also has a half-stake in Salym Petroleum Development NV, a JV with Gazprom Neft that is developing the Salym fields in the Khanty Mansiysk Autonomous District of western Siberia. Another JV with Gazprom Neft, in which Shell has a 50% interest, was to explore and develop blocks in the Gydan peninsula, in northwestern Siberia.

“The project is in the exploration phase, with no production,” Shell noted.

Equinor ‘Deeply Troubled’

“We are all deeply troubled by the invasion of Ukraine, which represents a terrible setback for the world, and we are thinking of all those who are suffering because of the military action,” said Equinor CEO Anders Opedal.

Equinor also is planning to commit to funding the humanitarian effort in the region.

“In the current situation, we regard our position as untenable,” Opedal said. “We will now stop new investments into our Russian business, and we will start the process of exiting our joint ventures in a manner that is consistent with our values. Our top priority in this difficult situation is the safety and security of our people.”

Equinor has been in Russia for more than 30 years. It entered a cooperation agreement with Rosneft in 2012. At the end of 2021 Equinor had $1.2 billion in noncurrent assets in Russia.

“We expect that the decision to start the process of exiting joint ventures in Russia will impact the book value of Equinor’s Russian assets and lead to impairments,” the company stated.

“We have employees from both Ukraine and Russia, and we are proud of how our people from different backgrounds and nationalities collaborate – with mutual respect, as one team in Equinor,” Opedal said.

Equinor said it was operating in compliance with European Union, Norwegian and U.S. sanctions. To that end, executives said they were maintaining “close contact with the authorities in Norway, the European Union, the United States, and other countries, and will continue to comply with any new sanctions relevant to our operations.”

Carolyn Davis contributed to this story.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |