Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

Kinder Morgan Progressing Key Natural Gas, Export Projects

The double whammy of Covid-19 and an oil market downturn resulted in stinging declines on the Kinder Morgan Inc. (KMI) pipeline network, but the midstream giant reported a fair share of green shoots during a second quarter earnings call.

Houston-based KMI on Wednesday reported higher natural gas transport volumes year/year and said nearly all of its tankage business was under contract during the second quarter. The company also reported that despite falling sequentially from the first quarter, physical deliveries to liquefied natural gas (LNG) facilities from pipelines were higher than last year.

The company is nearing completion of the Elba Liquefaction project, with the sixth of 10 production units placed into service during the quarter and the seventh earlier this month. The remaining three are expected to be in operation by the end of summer.

Gas exports to Mexico were flat year/year in the quarter, while deliveries to power plants were up about 6% because of coal switching and warmer weather.

“The services we provide continue to be needed to meet our customers’ energy transportation and storage needs,” said CEO Steven Kean. “Our business model, which secures much of our cash flows on a take-or-pay basis, independent of underlying commodity prices, positions us well even in the current environment.”

More quarterly earnings coverage by NGI may be found here.

With fewer cars on the road amid nationwide stay-at-home orders to slow the spread of the coronavirus, and an oil price crash that brought drilling activity to a standstill, KMI also took some hits.

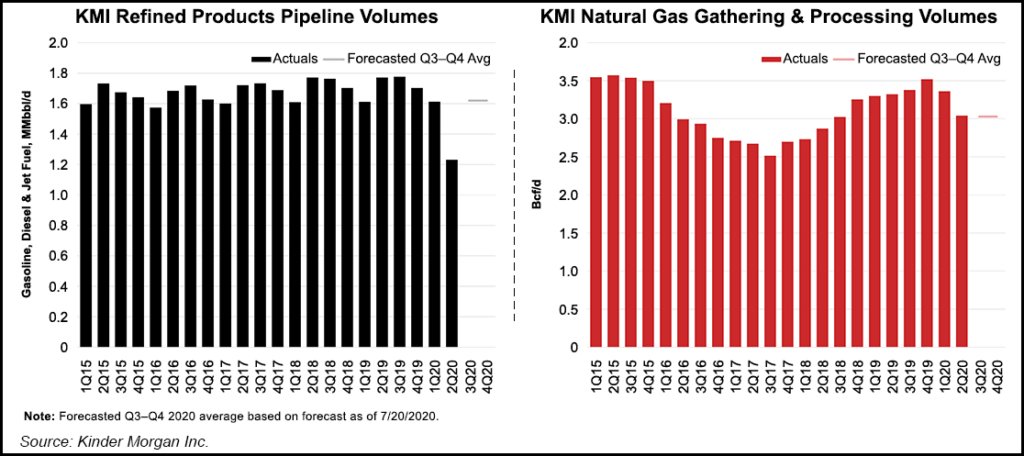

Crude and condensate pipeline volumes were down 26% compared to the year-ago period, and total refined product volumes were down 31% from last year. Shut-in wells lowered volumes across the gathering and processing (G&P) assets led to lower earnings for natural gas pipelines.

Although management has begun to see some increased demand for petroleum products, as well as higher G&P volumes, the third quarter may not deviate from 2Q2020 because of the uncertainty over the pandemic.

“To say that these are unprecedented times for the American economy is an understatement, and particularly for the energy business,” said Executive Chairman Richard Kinder. “We’ve faced the continued impact of Covid-19 together with the negative effect that buyers have had on worldwide demand for most of the products we move through our pipelines and handle at our terminals.”

Volumes bottomed out in May in the Eagle Ford Shale and in June in the Bakken Shale, with some increases in volumes thereafter as producers started to bring back shut-in production. The Haynesville Shale did not experience the magnitude of shut-ins in the oily plays, which produce associated gas, but volumes are expected to continue to decline because of the lack of drilling.

The rig count in the Haynesville on July 17 stood at 32, down from 51 a year ago. However, KMI continues to have conversations with producers about “incremental volumes” in 2021 given the current gas price curve.

Management was not prepared to discuss 2021, but executives indicated the previously reduced growth capital budget of $1.7 billion was a level that likely would remain in place for a while.

“The producer community is in a different situation even than what it was in 2016,” said Kean. “There’s not as much capital available to it. There’s a lot more emphasis on free cash flow that would tend to dampen what expectations would be for U.S. energy production. We’ve kind of got to make up for what we lost this year before you begin to see it grow again.”

Any capital investments would be approached “the same way we always have,” which is to look for opportunities that are attractive to shareholders, “but will have a high hurdle on it, particularly in this day and time. If you’re trying to build linear infrastructure, you have to have margin of safety in any investment that you’re thinking about making,” the CEO said. “We’ll have a high hurdle rate, give ourselves substantial headroom and margin for safety above our weighted average cost of capital.”

That said, the reduced growth potential should allow KMI to generate significant cash flow to increase the dividend, pay down debt and/or buy back shares, according to Kinder. “Our goal is to be disciplined in every respect. That means being very careful and high grading potential capital expansion expenditures, and keeping a focus on operating our assets in the most efficient way possible.”

PHP Progressing

The in-service of the 2 Bcf/d Gulf Coast Express last September cushioned the blow for KMI during the quarter, and the company now has a “line of sight” when it comes to the start of operations for the second conduit out of the Permian.

The Permian Highway Pipeline (PHP) that also runs from West Texas to the Gulf Coast is 79% mechanically complete, with mainline compression 97% complete. The 2 Bcf/d project is still on track to be fully operational in early 2021, though Kean said permitting delays pre-construction and some additional land acquisition/river crossing costs have impacted returns.

However, KMI is “still looking at a strong double-digit unlevered after-tax return on this project. Our team has continued to overcome obstacles and the number of remaining obstacles has shrunk considerably,” particularly in light of the Supreme Court decision to stay the injunction against the U.S. Army Corps of Engineers’ Nationwide 12 (NW12) permitting process, “but also as a result of adjustments that the team has made in routing and construction.”

PHP has faced strong opposition from landowners in the Texas Hill Country, and KMI is in the process of a reroute around a river crossing. In addition, some construction measures are underway to avoid impacting U.S. waterways and to reduce the number of crossings.

“We’ve taken some steps and some actions on our own in order to strengthen our position,” said Kean, who noted that NW12 is needed for certain construction activities but not for operation.

Consolidation In The Cards?

Chevron Corp.’s bid to acquire independent producer Noble Energy Inc., the largest oil-patch tie-up since the pandemic hit, is seen triggering more deals between companies struggling to emerge from the downturn and those looking for a bargain. Investors see KMI as a “long-term survivor” because of its “size, attractive assets and relatively strong balance sheet,” but acquisitions aren’t a priority, according to Kinder. He stopped short of ruling out a potential deal, but said the company would not “undertake such action to the detriment of its balance sheet.”

Kean said any potential deal would need to be in a business that KMI is “comfortable operating in,” and which it could bring “some considerable value to” in terms of synergies. “Then, you’ve got to find something that’s transactable,” said the CEO. “There are a number of screens that have to clear, and so you can’t predict it.”

KMI is tracking below the original $5.1 billion ($2.24/share) full-year guidance for distributable cash flow (DCF) because of the pandemic’s impacts on demand and the sharp decline in commodity prices. DCF is forecast to be below plan by slightly more than 10%.

KMI expects to use internally generated cash flow to fund 2020 dividend payments and discretionary spending. At the end of June, it had more than $3.9 billion of borrowing capacity and $526 million in cash, considered adequate to manage day-to-day cash requirements and debt.

Net losses in 2Q2020 totaled $637 million (minus 28 cents/share), compared with net profits in the year-ago period of $518 million (23 cents). DCF was $1.00 billion, down 11% from last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |