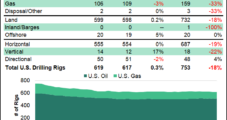

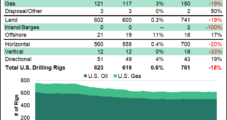

The U.S. natural gas rig count slid to 106 for the week ending Friday (April 19), down three rigs from the week prior and down 53 rigs year/year, according to the latest tally from oilfield services provider Baker Hughes Co. (BKR). The addition of five rigs in the oil patch lifted the combined U.S. rig…

Tag / Haynesville

SubscribeHaynesville

Articles from Haynesville

Production from Natural Gas Plays to Continue Declining This Spring, EIA Says

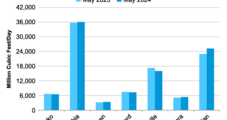

Natural gas production from seven key Lower 48 regions tracked by the U.S. Energy Information Administration (EIA) will slide from April to May, driven by declines in the Haynesville Shale and the Appalachian Basin. EIA’s latest Drilling Productivity Report (DPR), published Monday, modeled a combined 99.9 Bcf/d of natural gas output in May from seven…

U.S. Drops Two More Natural Gas Rigs as Haynesville Activity Slows, BKR Data Show

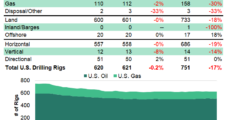

Including activity declines in the Haynesville Shale, the U.S. natural gas rig count skidded to 110 for the week ended Friday (April 5), down two week/week, updated numbers from Baker Hughes Co. (BKR) show. Total active U.S. natural gas rigs finished the week well shy of the 158 rigs running at this time a year…

Next Big Thing for U.S. Natural Gas Demand? Power-Hungry Data Centers, Say Williams Execs

The U.S. natural gas demand story has been geared to LNG growth, but there’s another story that could become even bigger: fueling a proliferation of computer data centers. The power-intensive artificial intelligence (AI) computer warehouses are to be fueled mostly by abundant and reliable domestic natural gas. It’s the next big thing, according to Williams…

Jones Cowboys Up Another $100M to Gain Two-Thirds Control of Haynesville Giant Comstock

Dallas Cowboys owner Jerry Jones, already majority shareholder in Haynesville Shale pure-play Comstock Resources Inc., has agreed to invest an additional $100.5 million into the company. Two Jones entities agreed to acquire 12.5 million shares of common stock in the private placement at $8.036/share. The price represents the average closing prices for the five trading…

Marcellus-Focused Range Resources Eyeing Flat Natural Gas Output Amid ‘Incredibly Challenging’ Prices

Appalachian Basin pure play Range Resources Corp. is targeting flat production growth in 2024 with a focus on natural gas liquids (NGL) to offset weak natural gas pricing, management said Thursday. “Near-term prices are obviously incredibly challenging for the industry, and we expect these historically low price levels should help keep a lid on natural…

Comstock Shedding Rigs, Suspending Dividend Amid Natural Gas Price Slump

Haynesville Shale pure-play Comstock Resources Inc. is pumping the brakes on natural gas drilling and shareholder distributions because of low commodity prices. “In response to weak natural gas prices, Comstock plans to suspend its quarterly dividend until natural gas prices improve,” management said. “In addition, the company plans to reduce the number of operating drilling…

Declines from Natural Gas Plays, Permian Gains to Hold Production Flat in March, EIA Says

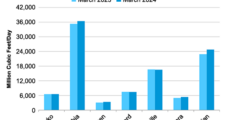

Growth in the Permian Basin, countered by declines in Appalachia and the Haynesville Shale, will see combined natural gas production from key Lower 48 regions hold steady at just over 100 Bcf/d in March, according to the U.S. Energy Information Administration (EIA). Total production from seven major Lower 48 producing regions — a list that…

Natural Gas Drilling Rises in U.S. as Haynesville, Marcellus Add Rigs, BKR Data Show

Led by gains in both the Haynesville and Marcellus shales, the U.S. natural gas rig count advanced to 121 for the week ended Friday (Feb. 9), up four rigs for the period, according to the latest tally from Baker Hughes Co. (BKR). Total U.S. oil-directed rigs were unchanged week/week at 499, and the combined domestic…

Tellurian Eyeing Divestment of Haynesville Natural Gas Business to Keep Driftwood LNG Afloat

Tellurian Inc. said Tuesday it is exploring opportunities to sell its upstream natural gas business in the Haynesville Shale. The idea is to reduce debt and shore up cash to advance the troubled Driftwood LNG export project on the Louisiana coast, said management of Houston-based Tellurian. As it seeks to commercialize the liquefied natural gas…