Infrastructure | E&P | NGI All News Access | Permian Basin

Pent-Up Permian Natural Gas Ramps Up with Gulf Coast Express

Kinder Morgan Inc. (KMI) ramped full operation of the 2 Bcf/d Gulf Coast Express (GCX) natural gas pipeline on Wednesday, unleashing long-stranded supply from the Permian Basin.

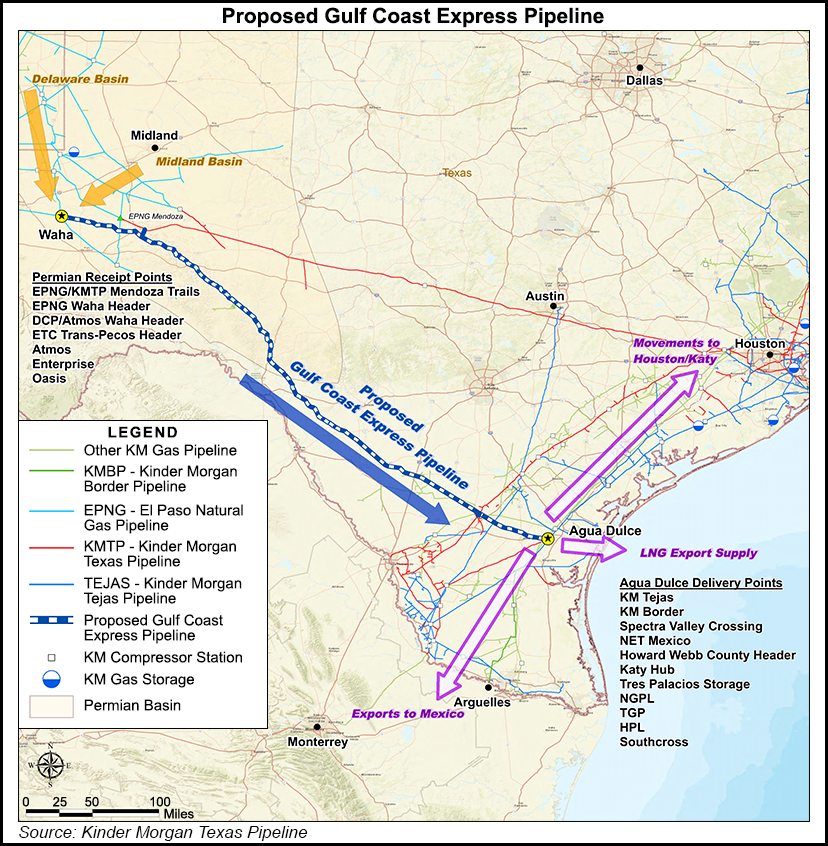

The fully subscribed $1.75 billion project is moving supply from West Texas near the Waha hub to the Agua Dulce hub in South Texas and beyond.

“With natural gas supplies projected to rise over the next 20 years from supply basins such as the Permian, our strong network of pipelines provides the ability to connect this supply to the growing markets along the Gulf Coast,” KMI’s Sital Mody, president of Natural Gas Midstream, said.

GCX began initial flows in mid-August. The in-service is a welcome relief for Permian producers, which this past spring paid as much as $9/MMBtu for customers to take the gas as rampant growth in associated output from the oil-rich basin outstripped takeaway capacity.

With Permian gas production projected to continue surging, KMI is looking forward to “delivering on additional infrastructure projects in the months to come,” Mody said. The KMI-led 2 Bcf/d Permian Highway Pipeline (PHP) gas pipeline, set to start up in the fall of 2020, would send gas through a 430-mile pipeline from Waha to Katy outside of Houston, with connections to the Gulf Coast and Mexico markets.

Nearly all of the capacity on PHP is subscribed under binding, long-term contracts. KMI affiliate Kinder Morgan Texas Pipeline (KMTP) and EagleClaw, a portfolio company of private equity giant Blackstone Energy Partners, initially are equally splitting ownership.

Another Permian takeaway project, the 2 Bcf/d Whistler Pipeline Project, which would move supply to the Texas coast and beyond, was sanctioned in June.

The 42-inch diameter Whistler project, set to start up in the second half of 2021, is backed by MPLX LP, WhiteWater Midstream and a joint venture (JV) between Stonepeak Infrastructure Partners and West Texas Gas Inc.. Whistler would connect to the 1.4 Bcf/d Agua Blanca Pipeline, a JV between WhiteWater, MPLX and Targa Resources Corp.

KMI is also mulling a Permian Pass, a gas system that could directly target liquefied natural gas export facilities on the Gulf Coast. In addition, KMI is investing about $250 million to increase capacity and improve connectivity across its Texas intrastate pipeline network to support increasing volumes as other Permian takeaway pipes deliver additional supply south.

KMTP owns a 34% interest in GCX and is operating the pipeline. Apache Corp.’s Altus Midstream Co., along with DCP Midstream LLC and an affiliate of Targa are the other equity holders.

GCX is underpinned by long-term volume commitments from DCP, Targa, Apache, Pioneer Natural Resources Co. and ExxonMobil Corp.

“Though ongoing GCX line-pack has driven material basis contraction (Waha-Katy 85 cents/Mcf), the current pipeline queue of GCX (3Q2019), PHP (4Q2020) and Whistler (3Q2021) provides intermittent relief for Waha,” said Tudor, Pickering, Holt & Co. (TPH).

“TPH’s estimated 2.0 Bcf/d of annual residue gas growth neatly matches additional takeaway capacity, lending itself to a status quo outlook,” analysts said Wednesday.

“The market will need to see progress on additional capacity late 2021, early 2022 to underwrite a more structural improvement in basin takeaway dynamics,” TPH analysts noted.

“From a gas macro perspective, we’re modeling initial flows of 1.2 Bcf/d and see GCX reaching capacity in 2Q2020, with speed of fill potentially having significant impacts on natural gas inventories through the fall/winter.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |