Atlanta-based oilfield specialist RPC Inc. saw its revenue climb in the first quarter from a year ago across all of its major service lines as oil prices increased and customers opened their wallets. CEO Richard A. Hubbell, in discussing the operator’s first-quarter performance, said RPC saw the environment improve as exploration and production (E&P) customers…

Earnings

Articles from Earnings

CNX Still Sees Utica Shale in Longer-Term Growth Plan

CNX Resources Corp. got a lift from stronger first quarter commodity prices as it continued executing on a broader seven-year plan it laid out in 2020. The company said free cash flow (FCF), up for the fifth consecutive quarter, came in at $101 million. It has also increased its full-year FCF guidance to $450 million…

Chevron Prioritizing ‘Highest Value’ Investments, Pacing Activity to Match Demand

Chevron Corp. has regiggered its global natural gas and oil portfolio over the past year, with the priority today going to the “highest value investments,” CFO Pierre Breber said Friday.Breber shared some insight into first quarter performance and the outlook ahead during a conference call. He explained how the San Ramon, CA-based energy major has…

ExxonMobil Profits on Strong Natural Gas, Oil Prices, with South Texas Cracker Set for 2021 Start Up

Recovering natural gas and oil prices, combined with cost cutting measures, sent ExxonMobil profits soaring in the first quarter, sending a strong signal that the global economy’s thirst for energy is rising. First quarter profits jumped to $2.7 billion (64 cents/share), from a loss of $610 million (minus 14 cents) in 1Q2020 and the loss…

Novatek Secures Buyers for All Arctic LNG 2 Volumes

PAO Novatek, Russia’s largest independent natural gas producer, has contracted all of the supply from its proposed Arctic LNG 2 export project under development north of Siberia on the Gydan Peninsula. The company said it has signed 20-year sales and purchase agreements (SPA) with the project’s participants for its 19.8 million metric tons/year capacity. Arctic…

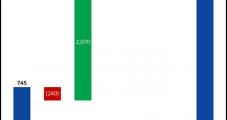

‘Substantial’ Boost to Patterson-UTI U.S. Rig Count Said Likely in June and July

U.S. contract driller Patterson-UTI Energy Inc. expects to see a “substantial” boost to the oil and gas rig count in June and July, CEO Andy Hendricks said Thursday. Hendricks, during a conference call to discuss first quarter performance and the outlook, said confidence is improving that 2021 will be a solid year for business in…

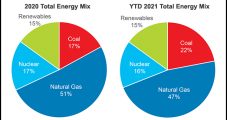

PG&E Assessing Long-Term Future of Natural Gas, CEO Says

For the next 15 years, natural gas will be an important transition fuel, but longer term, Pacific Gas and Electric Co. (PG&E) is still conducting an assessment of what its future will be, CEO Patti Poppe said Thursday. “In all the clean energy scenarios, and certainly in the near-term over the next 15 years, there…

Southern to Shed Sequent Wholesale Natural Gas Trading Arm to Reduce Risk

Southern Company, among the largest U.S. electric and natural gas distribution companies, said Thursday it had signed a deal to sell Sequent Energy Management, its wholesale gas trading and services business, in a move to reduce risk. The Atlanta-based firm disclosed the planned sale, expected to close in the third quarter, along with its first…

Liberty Sees Slowly Improving Fracture Market, E&Ps More ‘Comfortable’ with OFS Price Hikes

Denver-based Liberty Oilfield Services Inc. is reporting a “slowly improving market” in the Lower 48 for pressure pumping services, with customer conversations becoming more constructive, CEO Chris Wright said Wednesday. Speaking during the 1Q2021 conference call, Wright noted that the oilfield services (OFS) operator has doubled the size of its platform since the start of…

Whitecap Returns to Profitability on Canada Oil, Gas Acquisitions and Higher Prices

Improved prices for increased oil, natural gas and liquids volumes, achieved in part on corporate takeovers, fueled a return to profitability by Canadian producer Whitecap Resources Inc. in the first three months of this year. Whitecap oil production volumes grew year/year to 64,795 b/d from 56,631 b/d, with natural gas volumes hitting 129 MMcf/d from…