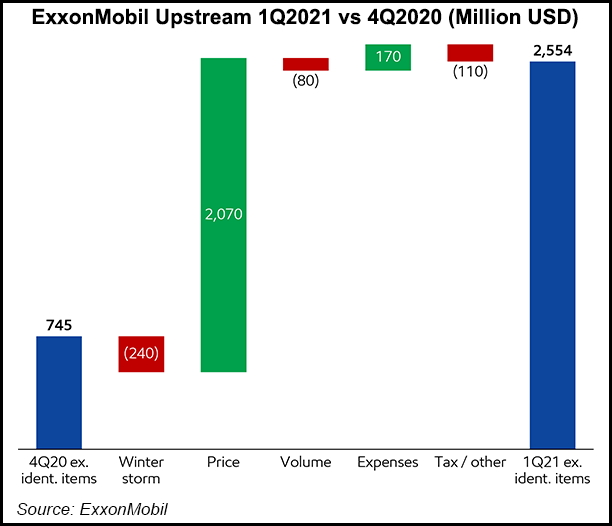

Recovering natural gas and oil prices, combined with cost cutting measures, sent ExxonMobil profits soaring in the first quarter, sending a strong signal that the global economy’s thirst for energy is rising.

First quarter profits jumped to $2.7 billion (64 cents/share), from a loss of $610 million (minus 14 cents) in 1Q2020 and the loss in 4Q2020 of $20 billion (minus $4.70/share). Boosted by efficiencies, capital and exploration expenditures came in at $3.1 billion, $4 billion lower than in 1Q2020.

On the pricing front, natural gas realizations improved by 33% in the quarter, with average oil prices up 42%.

“We made a lot of progress over the course of a challenging year,” CEO Darren Woods said during the quarterly conference call Friday. “The positive...