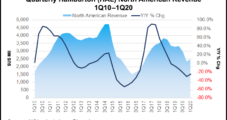

With U.S. producers now shutting in wells across the United States, the natural gas markets are likely to improve as the decline in associated production from oil “could lift North American prices sooner than previously thought,” Baker Hughes Co. CEO Lorenzo Simonelli said Wednesday.

Earnings

Articles from Earnings

NGI The Weekly Gas Market Report

Halliburton Cuts Capex by Half, Reduces Workforce, with Bottom in 2Q

Houston-based Halliburton Co., the largest pressure pumper in the Lower 48, no longer is seeing a “flight to quality,” but a flight to anywhere, as customers deal with the Covid-19 pandemic and low commodity prices, CEO Jeff Miller said Monday.

NGI The Weekly Gas Market Report

Schlumberger Forecasting 2Q as ‘Most Uncertain and Disruptive’ Period Ever Seen by Energy Industry

The duration of the global Covid-19 pandemic remains uncertain, but the oil and gas industry likely will face the “most severe” impacts in the second quarter, Schlumberger Ltd. CEO Olivier Le Peuch said Friday.He shared first quarter results and a partial outlook for the current quarter during a conference call with CFO Stephane Biguet in Houston.

NGI The Weekly Gas Market Report

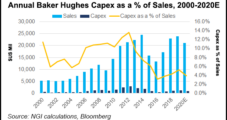

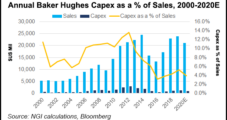

Baker Hughes Reduces Capex by 20%, Expects $15B Impairment in 1Q on Collapse in Oil, Gas Prices

In response to the sharp decline in oil and natural gas prices, as well as the Covid-19 pandemic, Houston-based Baker Hughes Co. plans to reduce capital spending this year by at least 20% from 2019, and it expects to record significant impairments for 1Q2020.

NGI The Weekly Gas Market Report

Baker Hughes Reduces Capex by 20%, Expects $15B Impairment in 1Q on Collapse in Oil, Gas Prices

In response to the sharp decline in oil and natural gas prices, as well as the Covid-19 pandemic, Houston-based Baker Hughes Co. plans to reduce capital spending this year by at least 20% from 2019, and it expects to record significant impairments for 1Q2020.

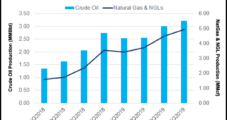

4Q2019 Earnings: Northern Oil Forecasting 55% Capex Cut, Positive FCF in 2020

Williston Basin independent Northern Oil and Gas, Inc. expects to trim its capital budget by over 55% to about $200 million and generate free cash flow (fcf) in excess of $100 million even at a $35 average oil price in 2020, management said Thursday. Northern has hedged about 27,600 b/d of 2020 oil production at an average price of $58/bbl, representing at least 75% of expected oil volumes for 2020 assuming the current pricing environment, CFO Chad Allen told analysts on a 4Q2019 earnings call.

NGI The Weekly Gas Market Report

Oxy Cuts Dividend by 86%, Joins Growing List of U.S. E&Ps by Reducing Spend through 2020

U.S. oil and natural gas producers reacted swiftly to the plummet in crude prices on Monday by reducing planned spending and activity through the rest of the year.

4Q2019 Earnings: NW Natural Moving Ahead with Decarbonization in Oregon, Washington

Portland, OR-based NW Natural expects to increase by up to 2% overall utility distribution supplies to renewable natural gas (RNG) this year in Oregon and obtain regulatory approval in Washington to offer the alternative fuel as an option.

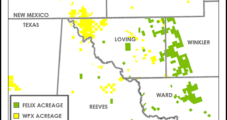

4Q2019 Earnings: $40 Oil Enough For WPX in 2020, Management Says

WPX Energy Inc. expects to generate positive free cash flow (FCF) in 2020, even if oil prices fall to $40/bbl, CFO J. Kevin Vann said during the recent fourth quarter 2019 earnings call.

4Q2019 Earnings: Range, Southwestern Slash Spending, But See Silver Linings in Appalachian Outlooks

Southwestern Energy Co. said Friday it would slash year/year spending by 20% in 2020, but annual production is still expected to climb by 10% over the same time, driven by investment in Southwest Appalachia, where it has focused in recent years.