NGI The Weekly Gas Market Report | E&P | Earnings | NGI All News Access

Baker Hughes Reduces Capex by 20%, Expects $15B Impairment in 1Q on Collapse in Oil, Gas Prices

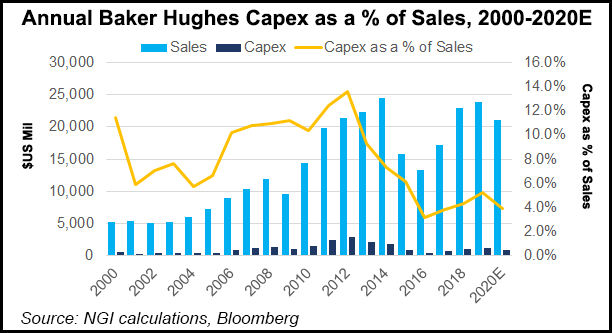

In response to the sharp decline in oil and natural gas prices, as well as the Covid-19 pandemic, Houston-based Baker Hughes Co. plans to reduce capital spending this year by at least 20% from 2019, and it expects to record significant impairments for 1Q2020.

When first quarter results are issued on April 22, the company expects to record a one-time charge of $15 billion related to goodwill impairments. The impairments do not impact cash flow. Capital expenditures (capex) have been slashed by 20% from 2019 gross spend of $1.24 billion.

“The company’s market capitalization declined significantly during the first quarter driven by current macroeconomic and geopolitical conditions including the collapse of oil prices driven by both surplus production and supply as well as the decrease in demand caused by the Covid-19 pandemic,” management said. “In addition, the uncertainty related to oil demand continues to have a significant impact on the investment and operating plans of our primary customers.”

A “triggering event” required the company to perform an interim quantitative impairment test at the end of the first quarter.

“Based upon the results of the impairment test, the company concluded that the carrying value of the Oilfield Services and Oilfield Equipment reporting units exceeded their estimated fair value, resulting in a goodwill impairment charge.”

The company also has approved a plan that would result in restructuring, impairment and other charges of $1.8 billion, of which $1.5 billion is to be recorded in 1Q2019. Future cash expenditures associated with the charges are estimated to be $500 million, with an expected payback within one year.

“These restructuring charges are designed to right-size our operations for anticipated activity levels and market conditions,” management said.

During the fourth quarter conference call in January, well ahead of the global pandemic that has destroyed global energy demand, CEO Lorenzo Simonelli had said macro fundamentals were “slightly improved…” He noted that the “dynamics from both the demand and supply side have become more positive,” with “continued positive economic data” from the United States.

“We believe that these variables should be supportive of a firm oil demand outlook in 2020 and one in which our customers will continue to execute their budget plans and advance important projects,” Simonelli had said at the time.

Despite the capex reductions for 2020, the company continues to maintain “solid financial strength and liquidity,” with cash and cash equivalents totaling $3 billion at the end of 2019, management noted.

In reaction to the announcement, Evercore ISI analysts said, “What immediately catches your eye is the company expects to record a noncash goodwill impairment charge of approximately $15 billion in the first quarter,” versus goodwill of $20.7 billion at the end of 2019.

“Recall that in the last downturn, Baker was going through the Halliburton proposed merger,” which was scuttled in 2016 after 18 months of negotiations that had begun at the start of the late 2014 oil price rout.

At the time Baker “could not cut costs and had to focus on the integration process,” as well as trying to meet federally required divestitures, Evercore analysts said.

“This time around Baker can respond quickly to adjust its cost structure, has better systems in place to make faster decisions, and is closer to its customer base. The headwinds in the market will only accelerate Baker’s current multi-year playbook. Its strategic focus remains on pulling forward structural changes with its procurement and supply chain, bringing its oilfield services’ performance closer to peers, and playing a leading role in both the energy transition and the digitalization of the oilfield. Baker will also accelerate its exit in certain markets where returns are unacceptable.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |