Shale Daily | Bakken Shale | E&P | Earnings | NGI All News Access | Permian Basin

4Q2019 Earnings: $40 Oil Enough For WPX in 2020, Management Says

WPX Energy Inc. expects to generate positive free cash flow (FCF) in 2020, even if oil prices fall to $40/bbl, CFO J. Kevin Vann said during the recent fourth quarter 2019 earnings call.

Assuming a West Texas Intermediate crude price of $50/bbl, the Tulsa-based independent expects to generate FCF in excess of $200 million in 2020, management said.

Vann told analysts during the conference call last Thursday that a $5 swing up or down in the price of oil could be expected to translate to a roughly $70 million impact on FCF.

Although the company was FCF negative (minus $83 million) for full-year 2019, it generated $101 million of positive FCF during the second half of the year.

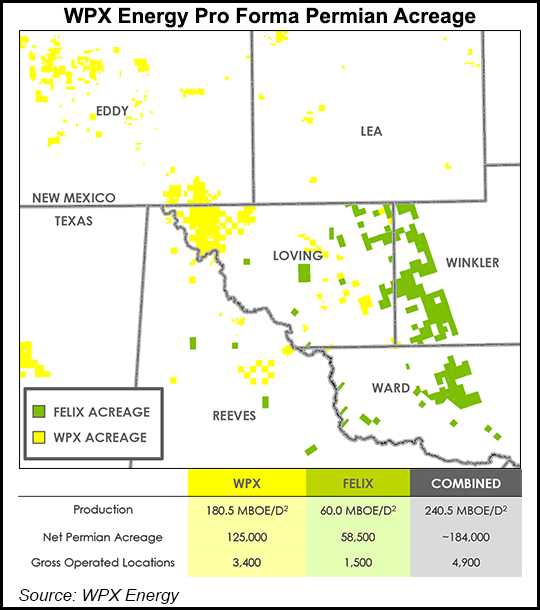

WPX, which operates in the Williston Basin and the Permian Basin’s Delaware sub-basin, expects to close its $2.5 billion acquisition of Permian operator Felix Energy LLC during the first quarter. Management said that WPX based the transaction’s economics on a $50 oil price.

WPX reported a 27% year/year (y/y) increase in 2019 oil production to 103,600 b/d, while natural gas output rose 32% to 214.7 MMcf/d.

COO Clay Gaspar highlighted that WPX delivered 5,600 b/d of additional oil output on top of guidance in 2019, while staying within the established capital budget.

Production of natural gas liquids (NGL) expanded 49% to 27,500 b/d for the year.

For 4Q2019, oil and natural gas production averaged 111,700 b/d and 223.2 MMcf/d, y/y increases of 16% and 9%, respectively. The Delaware accounted for 47,700 b/d of oil production, while the Williston supplied 64,000 b/d.

Natural gas output during 4Q2019, meanwhile, averaged 173.6 MMcf/d for the Delaware and 49.6 MMcf/d for the Williston.

Total production in 2019 was 166,900 boe/d, up 31% y/y, driven by increased oil, NGL and natural gas volumes from the Williston.

“From my perspective, after organically tripling our oil production through the drillbit…over the past three years in both the Permian and Williston Basins and then adding an attractive and accretive acquisition on top of that, doubts about our ability to deliver growth should be few and far between,” said CEO Richard Muncrief.

On a pro forma basis, WPX is forecasting total production of 241,000-256,000 boe/d in 2020, including 155,000-165,000 b/d of oil.

WPX plans to invest $1.68-1.8 billion of total development capital in 2020 on a pro forma basis, including $50-75 million for midstream opportunities. By comparison, capital spending in 2019 totaled $1.3 billion.

“The 2020 capital budget supports 12 rigs in the Delaware Basin upon closing the Felix transaction,” management said, adding it “also has three rigs deployed in the Williston Basin, with plans to drop a rig in the third quarter of 2020.”

WPX reported a net loss of $122 million (minus $0.29/share) for the fourth quarter, versus net income of $354 million ($0.83/share) in the year-ago period.

WPX reported full-year net income of $256 million ($0.61/share), up from $151 million ($0.57/share) in 2018. The company said it plans to implement a dividend in 2020 after integrating the Felix acquisition, with the first payment planned for the third quarter.

Want to see more earnings? See the full list of NGI’s 4Q2019 earnings season coverage.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |