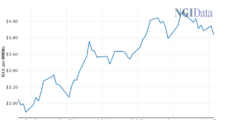

Top North American natural gas marketers reported stronger overall sales volumes for the second quarter as production gathered momentum in response to strong consumption and prices. A multitude of enduring demand drivers could fuel momentum through this year and into next, marketers and traders say. The 24 gas marketers included in the latest NGI Top…

Tag / Second Quarter

SubscribeSecond Quarter

Articles from Second Quarter

Buoyed by Rising Prices, SilverBow Expands Eagle Ford Position

Houston’s SilverBow Resources Inc. has continued its Lower 48 acreage expansion amid high commodity prices with a new natural gas-rich acquisition. The latest deal is an estimated $33 million all-stock transaction with an undisclosed seller. SilverBow is gaining 45,000 net acres in the Eagle Ford Shale of South Texas, bolstering its gas-weighted position in McMullen…

Stabilis Targeting First Gulf Coast LNG Fueling Event for Later This Year

Small-scale liquefied natural gas (LNG) supplier Stabilis Solutions Inc. expects its first marine fueling events on the Gulf Coast to happen later this year after recently adding several projects to its portfolio. CEO James Reddinger said last week the company is poised to benefit from expected growth in the bunkering sector as vessel owners move…

Chesapeake Recommits to Natural Gas as Portfolio, Production Set to Balloon

Chesapeake Energy Corp. on Wednesday strengthened its commitment to boost natural gas output, announcing an acquisition to bolt on acreage in the Haynesville Shale and laying out early plans to focus heavily on the play and other gas-rich assets in the Appalachian Basin next year. The company’s plan to acquire Vine Energy Inc. for $2.2…

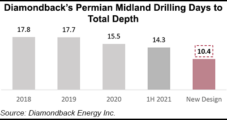

Diamondback Glides Oil Production Slightly Higher, Even as Efficiencies Send Rig Count Lower

Drilling efficiencies are giving Diamondback Energy Inc. a leg up to reduce spending, drop rigs and crews, but oil output is set to bump higher through the end of the year, according to CEO Travis D. Stice. During the recent second quarter conference call, Stice said the Midland, TX-based independent had decreased drill times from…

New Fortress Lands More Brazilian Customers on Natural Gas Shortages, Record Imports

New Fortress Energy Inc. said it had few issues in the second quarter signing up customers for liquefied natural gas (LNG) and power generation assets that it is developing in Brazil, where energy demand has set records this year. NFE said it inked eight sales agreements for 5.8 million gallons/day of LNG to underpin import…

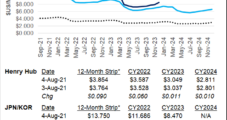

Cheniere Sees Record LNG Exports, but Commodity Price Exposure Leads to Losses

Cheniere Energy Inc. reported record liquefied natural gas (LNG) exports from its terminals in Louisiana and Texas during the second quarter, when demand surpassed expectations as the global market tightened further. The largest U.S. gas exporter loaded 139 cargoes, or 496 TBtu of LNG, in the second quarter. Results shattered a previous record of 133…

Permian’s Biggest E&P Pioneer Natural Rewarding Shareholders Amid Oil, Natural Gas Price Rally

Pioneer Natural Resources Co. will accelerate disbursing a variable dividend for shareholders amid a bullish commodity cycle and improved efficiencies across its one million acre-plus footprint in the Permian Basin, management said this week. “We are witnessing strong oil demand growth as the global macroeconomic environment continues to improve, with a corresponding improvement in commodity…

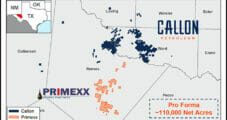

Callon Looks to Control More in Permian Delaware with $788M Primexx Merger

Houston-based Callon Petroleum Co. expects to control more than 110,000 net acres in the Permian Basin’s Delaware formation after clinching an estimated $788 million cash-and-stock deal to buy private explorer Primexx Energy Partners Ltd. Primexx, headquartered in Dallas, has around 35,000 net acres in the Delaware sub-basin within Reeves County in West Texas. The partnership…

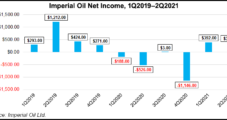

Imperial Gets Earnings Boost From Retail, Refining Rates

The Esso brand of more than 2,000 service stations across Canada and a trio of jumbo refineries in Ontario and Alberta helped put a tiger in Imperial Oil Ltd.’s financial tank during the first six months of this year. The ExxonMobil subsidiary’s downstream side reported first-half 2021 revenue of C$11.1 billion ($8.9 billion) from refined…