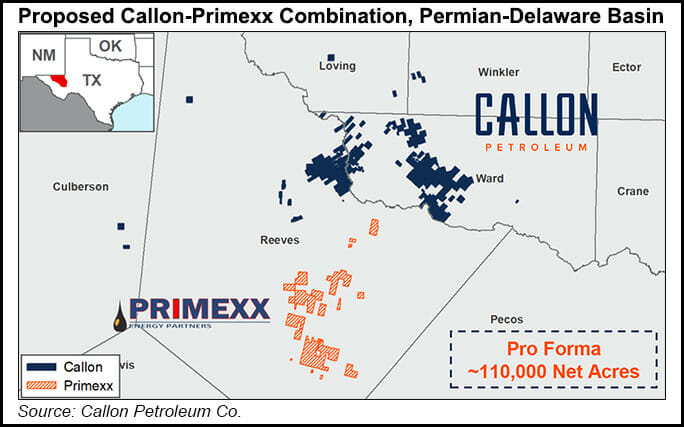

Houston-based Callon Petroleum Co. expects to control more than 110,000 net acres in the Permian Basin’s Delaware formation after clinching an estimated $788 million cash-and-stock deal to buy private explorer Primexx Energy Partners Ltd.

Primexx, headquartered in Dallas, has around 35,000 net acres in the Delaware sub-basin within Reeves County in West Texas. The partnership produced 18,000 boe/d net in 2Q2021. Based on the production volumes, Callon valued the transaction at around $43,800 per boe/d.

“The Primexx transaction checks every operational and financial box on the list of compelling attributes of consolidation,” Callon CEO Joe Gatto said. “The asset base adds substantial current oil production and a top-tier inventory to our Delaware portfolio, and fits...