Montney Shale pure-play Arc Resources Ltd. is forecasting strengthened pricing at the NOVA/AECO hub in western Canada relative to the U.S. Henry Hub over the coming months, according to management. In a conference call to discuss third-quarter earnings, CFO Kris Bibby said “we are excited for the immediate near term in the winter. We would…

Prices

Articles from Prices

Natural Gas Price Strength to Boost ExxonMobil’s 3Q Earnings Results

ExxonMobil is looking to report better-than-expected profits for the third quarter, lifted by stronger natural gas prices. The Irving, TX-based supermajor previewed the quarterly results In a Securities and Exchange Commission Form 8-K filing. The filing provides a “perspective regarding market and planned factors affecting 3Q2022,” relative to sequential results, the company said. “These factors…

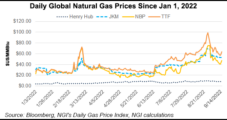

Specter of Recession Looms Large Over Global Natural Gas, Oil Markets

Threats of recession in the United States and across Europe are gathering force amid festering inflation and rapidly rising interest rates, developments that already tapered oil consumption and could impact commercial and industrial natural gas demand. The latest indicator: The U.S. Labor Department on Friday reported the job market remains tight but hiring is slowing.…

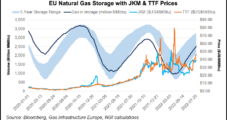

EU Members Disagree on Natural Gas Price Cap, Adopt Other Measures to Ease Energy Crisis

To help cope with the European energy crisis, all twenty seven European Union (EU) members approved several measures at a Brussels meeting on Friday, including levies on windfall profits made by fossil fuel companies. But, after weeks of debate from members and market speculation, a bloc-wide cap on natural gas import prices has been tabled…

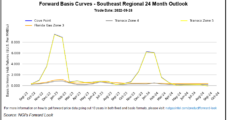

Natural Gas Forward Curves Retreat as Deadly Ian Rages Across Southeast

With natural gas production remaining stout – even amid temporary shut-ins ahead of Hurricane Ian – and cooler weather leaving its mark on storage inventories, natural gas forward prices continued to fall during the Sept. 22-28 week, according to NGI’s Forward Look. In the latter part of the period, all attention was on Florida, where…

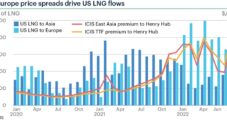

Europe Searching for Alternative Benchmark Amid TTF, LNG Disconnect

Proposals by the European Commission (EC) to tame soaring energy costs don’t alter the role natural gas plays on the continent and may do little to rein in the volatility that has ruled the market this year. The EC proposed revenue caps on some power producers, a windfall tax on the excess profits of fossil…

East Asia, TTF Prices Fall After Rally, With Some LNG Buying Deferred

The extended closure of the Nord Stream 1 pipeline from Russia to Germany caused a major rise in TTF prices on Monday and a similar reaction for East Asian spot LNG prices.

Freeport LNG Looks to Restart in November, Halting U.S. Natural Gas Price Rally

U.S. natural gas prices nosedived Tuesday afternoon after Freeport LNG Development LP outlined plans to restart partial operations at its export terminal on the Upper Texas Coast later than expected in November. The company had previously guided for a restart in early October. Initial production is now expected to begin in early to mid-November and…

Perfect Storm Leading to Record Price Spikes in U.S. Southeast – Listen Now to NGI’s Hub & Flow

Click here to listen to the latest episode of NGI’s Hub & Flow, where NGI Price & Markets Editor Leticia Gonzales is joined by RBN Energy managing editor Sheetal Nasta to discuss the factors driving unprecedented price spikes in the U.S. Southeast. In the podcast, Nasta discusses how high demand, tight pipeline capacity and various…

Freeport LNG Out for Months, Stranding 2 Bcf/d and Rattling Global Markets

Representatives with the liquefied natural gas (LNG) facility in Texas that suffered an explosion last week, Freeport LNG, said early Tuesday that the company does not expect the export facility to be fully repaired for months. The company is now targeting late 2022 for a return to full service instead of the initial guidance of…