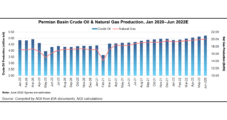

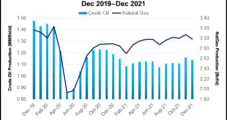

Permian Basin oil production is expected to grow by about 900,000 b/d in 2022 and by the same amount in 2023, according to new analysis by Rystad Energy. The Oslo-based consultancy sees production from the onshore play swelling from 4.7 million b/d in 2021 to 5.6 million b/d this year, and to about 6.5 million…

Tag / Oil Production

SubscribeOil Production

Articles from Oil Production

Centennial, Colgate’s $7B Merger to Create Permian Powerhouse

Centennial Resource Development Inc. and Colgate Energy Partners III LLC agreed to a roughly $7 billion merger of equals that would create what may be the largest pure-play exploration and production (E&P) company in the Permian Basin’s Delaware sub-basin. Publicly traded Centennial and privately held Colgate together hold roughly 180,000 net leasehold acres, 40,000 net…

OPEC-Plus Keeps Production Steady Even as EU Oil Ban Looms

OPEC and an allied group of oil-producing countries on Thursday agreed to extend a measured pace of production increases through June. The cartel said in a brief statement that a modest bump next month would support a balanced global market by the end of June. Specifically, OPEC-plus said it would target a 432,000 b/d increase…

‘Too Many Constraints’ to Rapidly Boost Lower 48 Oil, Natural Gas Production, Experts Say

Lower 48 oil and natural gas production is on the rise, particularly in the Permian Basin, but shortages of labor, materials and equipment will prevent a rapid supply response to current market tightness, according to experts. The Biden administration has called on U.S. producers to ramp up supply in order to lower gasoline prices and…

U.S. Oil Production Holds at 2022 High; IEA Says Covid Cuts Global Demand Outlook

Demand for petroleum products dropped last week amid lofty prices while U.S. producers held output at the highest level so far in 2022, the U.S. Energy Information Administration (EIA) said Wednesday. U.S. production for the week ended April 8 held even with the prior week at 11.8 million b/d — after hovering around 11.6 million…

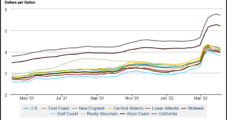

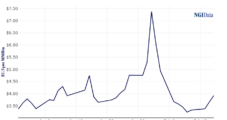

Tight Oil Supply, Russian Invasion Blamed for High Pump Prices, E&P Execs Tell Congress

U.S. oil and natural gas producers don’t set global commodity prices, nor are they attempting to gouge consumers, executives of the leading domestic explorers told Congress last Wednesday. Top executives of BP America Inc., Chevron Corp., Devon Energy Corp., ExxonMobil, Pioneer Natural Resources Co. and Shell USA Inc. discussed the reasons for sustained high prices…

Biden Bans Russian Oil, Natural Gas Imports in ‘Powerful Blow’ Against Putin’s ‘War Machine’

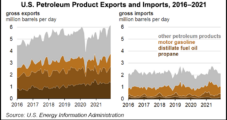

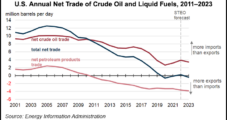

President Biden has banned imports of Russian oil and natural gas in a move that at once compounded already severe sanctions against the Kremlin and amplified the specter of record high energy prices amid a raging war in Ukraine. “Russian oil will no longer be acceptable at U.S. ports,” the president said in televised remarks…

U.S. Crude Producers Hold the Line on Supplies; Russian Aggression Clouds Outlook

U.S. producers kept output flat amid commitments to discipline and rapidly evolving geopolitical tensions that reached new heights Thursday with Russia’s invasion of Ukraine. Domestic production for the week ended Feb. 19 was flat with the two prior weeks and most of 2022 at 11.6 million b/d, the U.S. Energy Information Administration reported Thursday. While…

Devon Touts Permian Production but Overall Expense Control Even as Oil Nears $100

Devon Energy Corp. grew production in the Permian Basin in 2021 and expects to further ramp up in the prolific oil and natural gas region amid lofty crude prices this year. However, executives said they will hold the line on overall output in 2022, as uncertainty about long-term global energy needs outshine current surges in…

Bakken Oil Producers Seen Scaling Back Growth On Natural Gas Capture Concerns

Bakken Shale oil producers will likely limit annual production growth to 1-2% over the next 10 years, driven largely by concerns about natural gas capture, according to North Dakota’s top oil and gas regulator. Department of Mineral Resources director Lynn Helms discussed the outlook, along with the state’s latest production and drilling statistics, with reporters…