Centennial Resource Development Inc. and Colgate Energy Partners III LLC agreed to a roughly $7 billion merger of equals that would create what may be the largest pure-play exploration and production (E&P) company in the Permian Basin’s Delaware sub-basin.

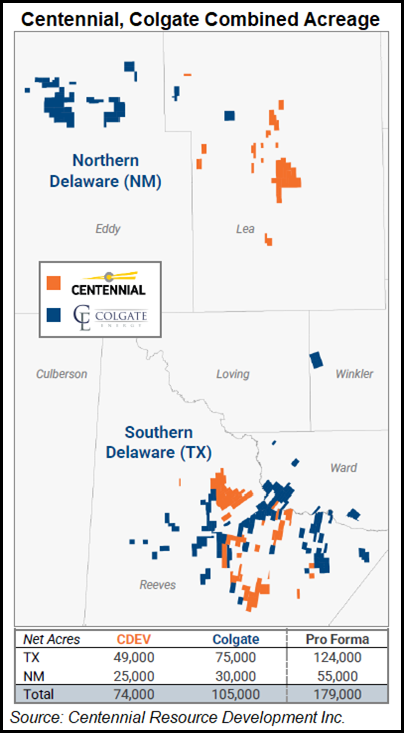

Publicly traded Centennial and privately held Colgate together hold roughly 180,000 net leasehold acres, 40,000 net royalty acres with current production of about 135,000 boe/d. The combined acreage spans the West Texas and southeastern New Mexico portions of the Delaware.

The proposed merger “significantly increases scale and drives accretion across all our key financial and operating metrics,” said Centennial CEO Sean Smith. “Colgate’s complementary, high-margin assets are a natural fit for Centennial, creating the...