OPEC-plus, the consortium of major oil producers led by Saudi Arabia, agreed to a substantial production cut late last week that could bolster prices and fuel more demand for Permian Basin crude. This, by extension, could drive continued lofty levels of associated natural gas from the prolific basin. Associated gas, produced alongside oil, contributed to…

Tag / Oil Production

SubscribeOil Production

Articles from Oil Production

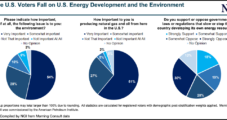

Most Americans Support U.S. Oil, Natural Gas Production, Poll Finds

A recent poll commissioned by the American Petroleum Institute (API) of U.S. registered voters has found that a majority agree that domestic natural gas and oil production could lower energy prices and ensure national security. The poll conducted from June 23-25 of 2,003 registered voters by Morning Consult for API found that at least 88%…

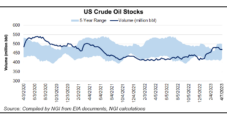

Domestic Crude Production Returns to 2023 High; EPA Aims to Jumpstart EVs

U.S. oil producers ramped up output last week even as near- and long-term demand grew increasingly uncertain amid recession fears and a new push to shift American drivers to electric-powered cars and trucks. Domestic exploration and production (E&P) firms generated 12.3 million b/d of oil for the week ended April 7, according to the U.S.…

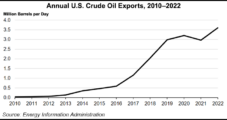

U.S. Crude Exports Hit Record in 2022, Lifted by Shift in Trade Patterns

U.S. crude oil exports hit an all-time high last year of 3.6 million b/d amid upheaval in global energy markets, according to the U.S. Energy Information Administration (EIA). EIA said U.S. oil exports increased by 22% year/year, or 640,000 b/d, in 2022. An increase in U.S. crude production, releases from the nation’s Strategic Petroleum Reserve…

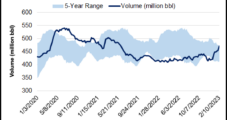

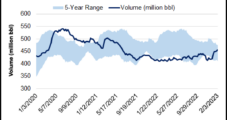

Domestic Crude Production Holds Strong, Prices Recover Despite Banking Crisis

U.S. exploration and production (E&P) firms last week approached the pandemic-era peak oil output level as catalysts for global demand gather and benchmark crude prices recover from fears imposed by financial system upheaval. E&Ps churned out 12.2 million b/d for the week ended March 24, according to the U.S. Energy Information Administration’s (EIA) Weekly Petroleum…

U.S. Crude Production Holds Strong Amid Fresh Signs of Demand Growth

American exploration and production (E&P) companies last week continued to pump oil at a robust pace, maintaining output at the highest level of the pandemic era. E&Ps produced 12.3 million b/d for the week ended Feb. 17, even with the prior week and the high mark of 2023, data from the U.S. Energy Information Administration’s…

American Oil Producers Keep Output Elevated; IEA, OPEC Ramp Up Demand Forecasts

U.S. crude production held firm at a pandemic-era high as new forecasts called for rising global demand tied to an expected surge in Chinese travel fuel consumption. American producers generated 12.3 million b/d for the week ended Feb. 10, on par with the prior week and the high mark of the past nearly three years,…

U.S. Oil Production Reaches New Pandemic-Era High, Contributes to Natural Gas Gains

Domestic crude production climbed to the highest level since 2020 as demand for petroleum products pushed ahead last week, the U.S. Energy Information Administration (EIA) said Wednesday. American producers generated 12.3 million b/d for the week ended Feb. 3, up by 100,000 b/d from the prior week, data from EIA’s latest Weekly Petroleum Status Report…

Los Angeles County Banning New Oil, Gas Wells

After the city moved last month to ban new oil and natural gas drilling within its borders, the Los Angeles County board has followed suit, banning new drilling activity beginning this month. County officials unanimously voted to adopt an ordinance amending the zoning law, banning any new oil and gas wells or production facilities in…

U.S. Crude Production Climbs – but Petroleum Demand Drops 20%

Domestic oil production bounced back to near pandemic-era highs in the final week of 2022, while demand plummeted following a run-up to the Christmas holiday. The U.S. Energy Information Administration (EIA) said Thursday output for the period ended Dec. 30 climbed 100,000 b/d week/week to 12.1 million b/d. That put production within 100,000 b/d of…