Management at global petrochemical giant Dow Chemical Co. said Thursday that manufacturing sites with access to shale natural gas resources enjoyed a favorable position during the first quarter of 2022. “Natural gas has been stubbornly high,” said CEO Jim Fitterland during Dow’s earnings call for the first quarter of 2022. “It was higher than last…

Inflation

Articles from Inflation

Accelerating Inflation Presents Natural Gas, Oil Companies Potential for Profits and Pitfalls

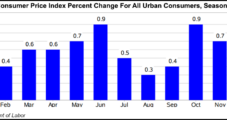

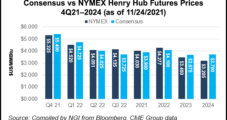

Soaring energy prices – driven most recently by spikes in crude – helped drive the U.S. inflation rate to a 40-year high in January, creating both opportunity and risk for oil and natural gas companies. The U.S. Bureau of Labor Statistics (BLS) said Thursday the consumer price index (CPI) jumped 7.5% in January from the…

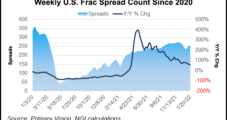

RPC Eyes Upping Fracturing Fleet Count for 2022

Oilfield services (OFS) and equipment provider RPC Inc. said it might activate another hydraulic fracturing fleet but added that likely would not occur during the first six months of this year. CEO Richard A. Hubbell said that he sees “many indications of continued growing activity levels and improved pricing” in the new year. Last spring,…

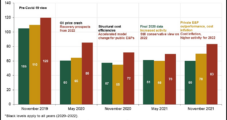

Feeling Inflation Pinch, Permian E&Ps Targeting Further Efficiency Gains

Continued efficiency improvements are expected to be critical for natural gas and oil producers in the Permian Basin this year as cost inflation for oilfield services (OFS) takes full effect.

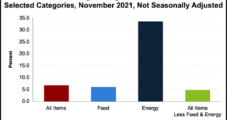

Oil, Natural Gas Prices Drive Sustained Surge in Inflation

Lofty oil and natural gas prices played outsized roles in fueling spikes in inflation this year. November proved no exception, with price increases reaching a pace last recorded nearly four decades ago. The U.S. Bureau of Labor Statistics (BLS) said Friday the consumer price index surged 6.8% in November from the same month a year…

Lower 48 Oil, Gas Spending Seen Rising 19% in 2022 on Cost Inflation, Activity Uptick

Spending by Lower 48 oil and natural gas producers is set to rise by 19.4% next year to $83.4 billion from an expected $69.8 billion in 2021, according to new analysis by Rystad Energy. Service price inflation is expected to account for $9.2 billion of the spending growth, with increased activity contributing $8.6 billion, said…

U.S. E&Ps Said on Verge of ‘Energy Super Cycle’ Heading into New Year

The U.S. exploration sector delivered its fourth straight quarter of outperformance in 3Q2021, setting the sector up for what should be solid growth in 2022, according to energy prognosticators. Solid cash flow by the domestic exploration and production (E&P) companies was accelerated by the high commodity prices. However, the three-month period also represented a “stabilized…

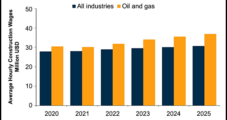

U.S. Oil, Natural Gas Projects Said Likely to Face 10% Hike in Wages, Supply Chain Inflation to 2023

U.S. oil and natural gas projects are forecast to face higher costs going forward as wages rise along with supply chain inflation. The engineering, procurement, construction and installation (EPCI) segment may be the “first to record a double-digit percentage hike in costs,” according to a new analysis by Rystad Energy. Domestic EPCI costs, driven by…

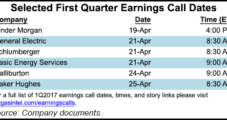

E&P, OFS Sectors Coming on Strong in First Quarter

Winter is over for the long-distressed energy sector in North America, with upstream operators and service companies likely to have more spring in their steps as they offer up first quarter results.

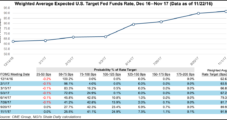

Oil Price Outlook Improving; Fed Interest Hike Might Help, Avista Economist Says

The current outlook for crude oil prices is much better than it was six months ago, and Federal Reserve (Fed) Chair Janet Yellen’s indication the Fed may increase interest rates soon could further boost those prices, according to Avista Utilities economist Grant Forsyth.