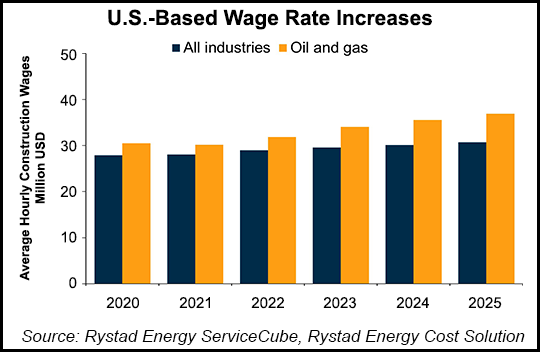

U.S. oil and natural gas projects are forecast to face higher costs going forward as wages rise along with supply chain inflation.

The engineering, procurement, construction and installation (EPCI) segment may be the “first to record a double-digit percentage hike in costs,” according to a new analysis by Rystad Energy.

Domestic EPCI costs, driven by increases in salaries and materials, are forecast to jump by about 10% in 2023 from current levels. Capital expenditures (capex) by U.S. companies for EPCI in 2023 could reach $15.5 billion, or around $1.4 billion higher than under the current cost status quo.

“If EPCI players fail to adapt to the rising costs, those executing lump-sum contracts and using outdated assumptions for procurement and construction indices will...