E&P | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Oil Price Outlook Improving; Fed Interest Hike Might Help, Avista Economist Says

The current outlook for crude oil prices is much better than it was six months ago, and Federal Reserve (Fed) Chair Janet Yellen’s indication the Fed may increase interest rates soon could further boost those prices, according to Avista Utilities economist Grant Forsyth.

“Both the EIA [Energy Information Administration] and the future markets are very similar right now,” Forsyth said during a webinar hosted by the Northwest Gas Association (NWGA) Thursday.

“What this has done is really stabilize the exchange rate between the United States and Canada, and it has helped stabilize investment, which has been heavily reliant on the energy sector.”

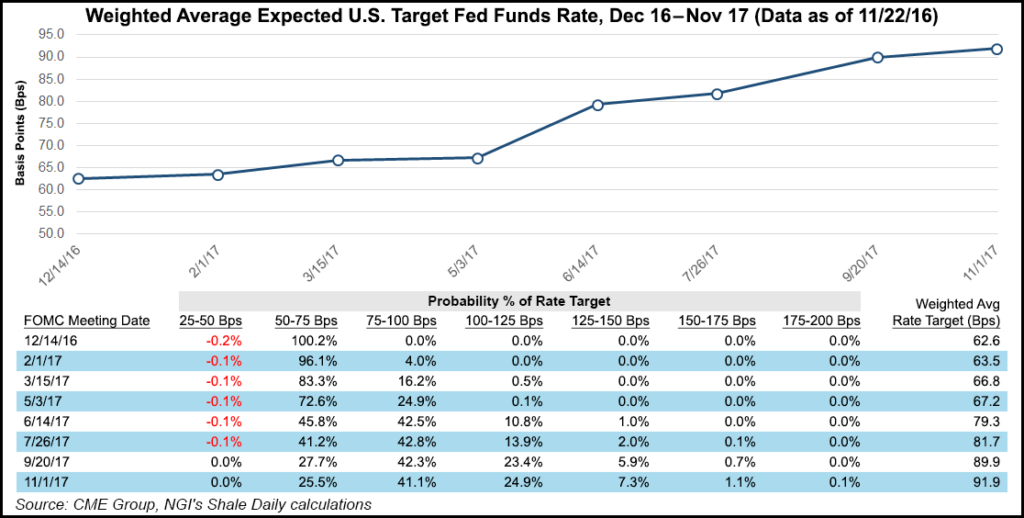

Forsyth thinks the Fed is getting closer to having to hike what have been historically low interest rates. “If somehow the economy does receive a negative economic shock and maybe slips into a recession, with today’s historically low interest rates, we don’t have a lot of room to maneuver, so this is what is sort of pushing her to raise interest rates.”

Oil and natural gas prices have a large impact on overall inflation rates, Forsyth said in response to a question from NGI. “One of the reasons that inflation has been so weak is that energy prices have a big impact on personal expenditure and consumer price indices. Conversely, if you have a big, rapid increase in energy prices, they are going to be wrapped around the inflation rate,” Forsyth said.

“The hope is for a modest increase in energy prices so you don’t have a shock to inflation, but at the same time it is a strong enough recovery to get investment re-started in the energy business, which has become increasingly important to both the United States and Canada.”

An overlooked, but important, macro economic development in the past year has been the appreciation of the U.S. dollar to the Canadian dollar as caused by collapsing global oil prices, which bodes well for trade and energy sectors of both nations, Forsyth thinks.

“Forecasts in the EIA and future curves are higher than they were in the spring, and that is likely to help stabilize investment in the energy business,” Forsyth said.

On a regional basis, the Pacific Northwest economy is growing much faster than the nation as a whole, and the same is true for British Columbia (BC) in Canada compared to the nation as a whole. In the United States, the growth is strongest in smaller and mid-sized population centers compared to Seattle and Portland, Forsyth said. That is less true in BC, where Vancouver and Victoria are the center of all the growth.

Forsyth said he hopes the Trump administration takes a mostly hands-off approach to the Fed as recent administrations have, but he thinks it will take a very active role in encouraging new energy infrastructure projects. “That includes pipelines — gas and oil — and liquefaction facilities,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |