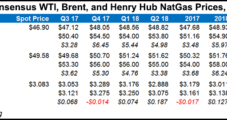

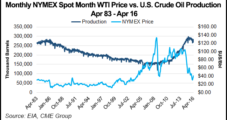

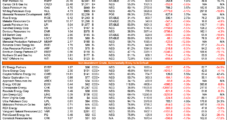

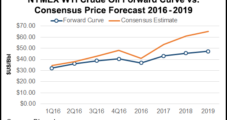

A decline in the U.S. rig count through the second half of 2017 “appears inevitable” based on recent oil prices, but an undersupplied market could drive prices and drilling activity sharply higher in 2018, analysts at Raymond James & Associates said Monday.

E&Ps

Articles from E&Ps

Top 50 U.S. E&Ps Reinvesting at ‘Robust’ Levels, Despite Stagnant Prices

The 50 largest U.S. explorers demonstrated their commitment to resource acquisition and development last year despite low commodity prices, with plowback percentages that exceeded the five-year average of 132%, according to a new reserves study.

Questions Precede OFS, E&P Quarterly Earnings on Stagnant Prices, Rising DUC Inventories

Natural gas and oil operators have begun dishing their second quarter results, and energy experts cite cautious optimism that the industry’s recovery will not be waylaid by stagnant commodity prices and lack of demand.

U.S. E&Ps Again Tracking to Overspend, Toss Capital Discipline

Old habits die hard, and for exploration and production (E&P) companies long inclined to overspend, a commitment to curb outlay to align with cash flow may go out the window as they contend with higher prices for equipment and services, increasing labor shortages and peer pressure to build volumes.

E&Ps See ‘Light at the End of a Tunnel and Not an Oncoming Train,’ Says Halliburton CEO

The North American onshore industry has shifted its thinking towards recovery, and Halliburton Co.’s second quarter results likely represent the bottom as exploration and production (E&P) companies look ahead to growth, CEO David Lesar said.

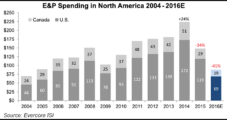

North American E&Ps to Cut 2016 Capex by 41%, with Onshore Spend Down by Half, Says Survey

North America’s oil and gas operators, more than any group worldwide, are enduring the “most extreme” capital spending cuts, with expenditures likely to drop by 41% on average from 2015 and the onshore sector seeing the most pain, according to Evercore ISI.

Higher Commodity Prices, Even Lower F&D Costs Said to Be Needed to Lift Onshore E&P Fortunes

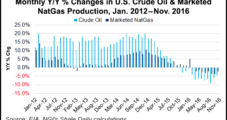

Brutal could describe the earnings results for the exploration sector in the final three months of 2015, but could sharp reductions in capital expenditures (capex) have set in motion a much tighter production supply, with improved pricing sooner than later? It’s not likely before the end of this year because a confluence of factors, analysts said.

Oil & Gas Liquidity Stress Index At Record High, Says Moody’s

Liquidity stress in the oil and gas industry reached its highest-ever level in February, continuing a trend that began in late 2014, Moody’s Investors Service said in a note published Tuesday.

More Pure-Play E&Ps Confronting Bankruptcy, Deloitte Finds

More than one-third of the global pure-play producers, an estimated 175 operators, face the risk of slipping into bankruptcy this year as they face fewer options than even last year, according to Deloitte LLP.

As U.S. E&Ps Ax Budgets, Raymond James Forecasting Sharper Decline in Rig Count

Raymond James & Associates Inc. analysts are standing by their call for West Texas Intermediate oil prices to reach $50/bbl later this year in the face of a futures strip that is “simply unsustainable,” but until the price cavalry arrives, the U.S. rig count is going to be hacked even more as producers cut back their spending.