U.S. and Canadian producers have hedged only 15% of total oil and natural gas volumes for 2016 and 5% of their volumes for 2017, which may leave them even more exposed to depressed prices.

E&Ps

Articles from E&Ps

Many E&Ps Still Accessing Capital Markets, With Cuts ‘Relatively Light,’ Fitch Says

The sky-is-falling scenario that producers were expected to face as crude oil prices collapsed last year has yet to make a big dent in lending, according to Fitch Ratings.

E&Ps Get Reprieve in Fall Redeterminations, But Spring Could Be Harsh

Exploration and production (E&P) companies may have been stressed about the fall redeterminations this month but the banks have been “surprisingly gentle,” according to a review by Jefferies LLC.

North American E&Ps Exposed in 2016 Based on Hedging Analysis, Says IHS

North American exploration and production (E&P) companies have only hedged about 11% of their natural gas and oil volumes in 2016, leaving many possibly facing financial stress, according to an IHS Inc. performance analysis.

Lower Spending in 2016 by E&P, OFS Sectors Inevitable, Analysts Say

Energy analysts are beginning to piece together capital spending outlooks for 2016 based on surveys, conversations and anecdotes, with one common theme emerging: it’s lower for longer. Just how much longer is the puzzle.

E&Ps Bracing For Redetermination Redux

Before the fall redetermination season in October, operators squeezed for cash are more worried than they were a few months ago about their ability to borrow against natural gas and oil reserves.

E&Ps Working to Survive Rather Than Thrive, Says Barclays

Producers have shifted from growth to survival mode, applying technology to overcome the constraints of diminished revenue expectations, according to Barclays Capital. The investment firm held its annual energy conference last week, which featured presentations by exploration and production (E&P) companies.

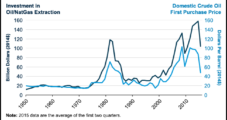

U.S. E&P Capex Down 60% from 2014, Operators Also Less Hedged

Spending by U.S. producers is estimated to be down around 60% from 2014 — twice as much as some analysts have estimated, Raymond James & Associates Inc. said Monday. North American producers also have less protection from sustained low commodity prices than they did a year ago because of less hedging, according to Barclays Capital.

Energy Industry Coping by Cutting Jobs, Revising Financial Strategies

U.S. operators have begun implementing various ways to maintain their exploration and development programs in the United States, with some tweaking hedging strategies, others working with lenders and some scrapping expansion plans. Even more appear to be cutting back on employees and contractors, according to Friday’s jobs report.

E&P Manufacturing Methods Forecast to Dominate Headlines in 2014

Sustained natural gas and liquids output again may dog commodity prices in 2014, but analysts are keen to see how U.S. exploration and production (E&P) companies hone their operations into manufacturing marvels.