EQT Corp. has suspended its quarterly dividends, while Basic Energy Services Inc. has cut spending by 60% and begun closing some locations, as the global oil and gas industry defends against forces that were unforeseen only three months ago.

E&Ps

Articles from E&Ps

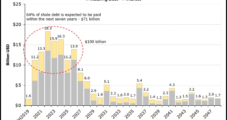

‘Staggering’ Debt Has North American E&Ps, Especially Natural Gas-Weighted, Risking Default

With a “staggering level” of debt maturing in the 2020-2024 time frame and limited access to credit, North America’s exploration and production (E&P) companies, particularly natural gas-focused operators, face an increased risk of default, according to new research from Moody’s Investors Service.

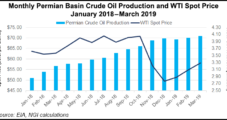

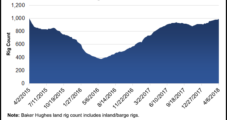

Lower 48 Oil Production Forecast to Slow to Standstill in 2021

U.S. shale and tight oil production is forecast to slow in 2020 before flattening out in 2021, according to IHS Markit research.

Lower 48 E&P Bankruptcies Not ‘Epidemic,’ Says Rystad

Financial adversity has continued to dog Lower 48 operators this year, with more voluntary restructurings, but the bankruptcies aren’t a harbinger of doom, according to Rystad Energy research.

NGI The Weekly Gas Market Report

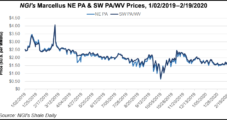

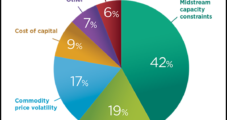

Capital Discipline, Mergers, Permian Natural Gas at Center Stage for 1Q Calls

Consolidation, capital discipline and natural gas prices in the Permian Basin are likely to be high on the list of investor queries during the first quarter conference calls, as the earnings season begins in earnest.

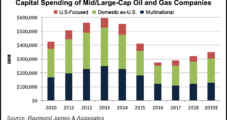

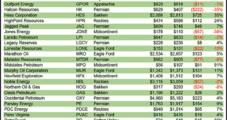

U.S. E&P Capex Discipline ‘Not Just Lip Service,’ Says Raymond James

Global oil and gas capital spending had been on the rise for two straight years, but the collapse in oil prices late last year puts a kibosh on a “massive escalation” in expenditures anytime soon, according to Raymond James & Associates Inc.

Domestic E&Ps Still Walking Disciplined Capex Path, Moderating Drilling Plans

U.S. publicly traded producers appear to be embracing the “Shale 2.0” mantra of spending discipline and shareholder returns, with capital spending trending down from 2018, according to analysts.

Big Oil, Super Independents Appear Unlikely to Slow North American Activity in 2019

North American exploration spending in 2019 is tracking higher for the third consecutive year, albeit at a slower pace, with natural gas-heavy budgets poised to reset higher, while oil operators weigh the implications of extended lower prices.

E&P Borrowing Capacity Looking Solid; Bankruptcy Filings Falling Sharply

The outlook is bright for the U.S. oil and gas producers, based on a survey about borrowing base redeterminations by Haynes and Boone LLP.

U.S. E&Ps Practicing Capital Discipline Even as Activity Climbs Onshore

The global oil and gas industry has begun its second year of recovery, but capital spending only climbed last year by about half as much as originally budgeted, and it is poised to surge this year, according to a survey by Raymond James & Associates Inc.