Kevin Dobbs joined the staff of NGI in April 2020. Prior to that, he worked as a financial reporter and editor for S&P Global Market Intelligence, covering financial companies and markets. Earlier in his career, he served as an enterprise reporter for the Des Moines Register. He has a bachelor's degree in English from South Dakota State University.

Archive / Author

SubscribeKevin Dobbs

Articles from Kevin Dobbs

Natural Gas Futures, Cash Prices Scratch Out Modest Gains

The prompt month extends win streak to three days LNG hangs steady along with weather demand Cash prices advance with cool spring air June natural gas futures on Tuesday barely extended a win streak to three days as traders took profits and volume proved light while the prompt month tested technical resistance at the $3.00…

June Natural Gas Futures Tread Water Before $3.00 Threshold; Cash Prices Climb

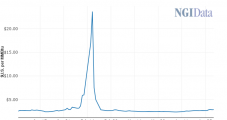

June natural gas futures on Tuesday barely extended a win streak to three days as traders took profits and volume proved light while the prompt month tested technical resistance at the $3.00 level. Futures advanced over the course of April and early this month as supply/demand balances tightened. On Tuesday, the June Nymex contract eked…

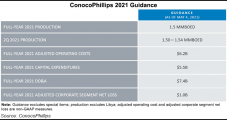

ConocoPhillips Bounces Back Along with Oil Demand, February Spike in Natural Gas Prices

ConocoPhillips’ 1Q2021 profit marked its first amid the coronavirus pandemic and reflected both a recovery in global oil demand and a winter surge in domestic natural gas prices. The Houston-based energy giant in the first quarter also closed its $9.7 billion acquisition of Concho Resources Inc., forming a Permian Basin powerhouse that will rival the…

With LNG and Cash Prices Strong, June Natural Gas Futures Advance

Weather-driven demand potential increased Demand for U.S. exports of LNG held strong Cash prices advanced ahead of cool shots Natural gas futures advanced for a second consecutive session on Monday, as traders mulled weather-driven demand potential, continued strong liquefied natural gas (LNG) volumes and the potential for light storage levels moving through the summer months. …

June Natural Gas Futures Inch Higher Amid LNG Strength, Potential for Storage Depletion

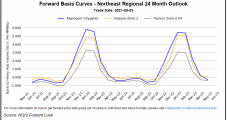

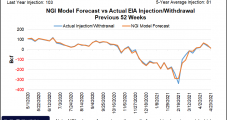

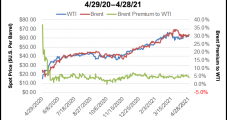

Natural gas futures advanced for a second consecutive session on Monday, as traders mulled weather-driven demand potential, continued strong liquefied natural gas (LNG) volumes and the potential for light storage levels moving through the summer months. The June Nymex contract advanced 3.5 cents day/day and settled at $2.966/MMBtu. July rose 3.6 cents to $3.014. Spot…

Higher Commodity Prices, Strengthening Economies Improve Outlook for Global Energy Demand, Moody’s Says

Moody’s Investors Service has upgraded its outlook for the global energy industry, citing a sustained increase in commodity prices and expectations for global economic growth to drive increased oil and gas demand over the next 12 to 18 months. The firm said it expects that, as vaccine programs become prevalent and the coronavirus outbreaks fade,…

Southern to Shed Sequent Wholesale Natural Gas Trading Arm to Reduce Risk

Southern Company, among the largest U.S. electric and natural gas distribution companies, said Thursday it had signed a deal to sell Sequent Energy Management, its wholesale gas trading and services business, in a move to reduce risk. The Atlanta-based firm disclosed the planned sale, expected to close in the third quarter, along with its first…

CenterPoint Inks $2.15B Deal to Sell Natural Gas Utilities in Arkansas, Oklahoma

Utility CenterPoint Energy Inc. said on Thursday it agreed to sell its natural gas distribution businesses in Arkansas and Oklahoma to Summit Utilities in a $2.15 billion cash deal that could help fund the seller’s transformation strategy. The assets include 17,000 miles of pipelines in Arkansas and Oklahoma, serving more than half a million customers.…

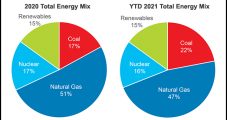

Domestic Oil Inventories Increase as Imports Rise; OPEC-Plus Sticks With Production Bump

U.S. oil stocks increased for a second consecutive week, albeit modestly, despite a bump in demand alongside a recovery in economic activity and ongoing coronavirus vaccine rollouts. In its Weekly Petroleum Status Report (WPSR), the U.S. Energy Information Administration (EIA) said Wednesday that crude inventories for the week ended April 23 — excluding those in…

Before U.S. Senate Committee, Critics Blast Biden’s Moratorium on Federal Oil, Gas Lease Sales

Oil and natural gas industry leaders and politicians railed against President Biden’s decision to freeze oil and gas lease sales on federal lands and waters through at least June during a Senate Energy and Natural Resources Committee hearing on Tuesday. Government officials, meanwhile, defended the pause as a necessary step as they review the program…