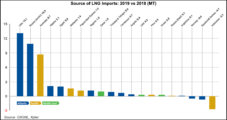

The liquefied natural gas (LNG) market had a banner year in 2019, with strong import growth and record production, but the trade faces tests in the year ahead as the coronavirus outbreak continues to impact nearly every facet, according to the trade group that represents companies active in importing worldwide.

Topic / Coronavirus

SubscribeCoronavirus

Articles from Coronavirus

Canada’s Shut-In Oil Production from Coronavirus Likely to Exceed 1.1 Million b/d in Second Quarter

An analysis indicates that Canada’s oil production appears to be the most affected by the Covid-19 pandemic and from reduced oil demand, with shut-ins estimated to climb above 1.1 million b/d between April and June.

Canada’s Shut-In Oil Production from Coronavirus Likely to Exceed 1.1 Million b/d in Second Quarter

An analysis indicates that Canada’s oil production appears to be the most affected by the Covid-19 pandemic and from reduced oil demand, with shut-ins estimated to climb above 1.1 million b/d between April and June.

No Resurrection for Natural Gas as Storage, Weather Take Down Futures Another Notch Ahead of Easter

While some of the world’s largest oil producers were meeting to discuss potential curtailments, natural gas traders were making cuts of their own, slashing Nymex futures even further as demand impacts from Covid-19 became increasingly clear. After plunging as low as $1.721, the May contract settled Thursday at $1.733, down 5.0 cents day/day. June dropped 3.3 cents to $1.863.

No Resurrection for Natural Gas as Storage, Weather Take Down Futures Another Notch Ahead of Easter

While some of the world’s largest oil producers were meeting to discuss potential curtailments, natural gas traders were making cuts of their own, slashing Nymex futures even further as demand impacts from Covid-19 became increasingly clear. After plunging as low as $1.721, the May contract settled Thursday at $1.733, down 5.0 cents day/day. June dropped 3.3 cents to $1.863.

NGI The Weekly Gas Market Report

‘Big Cut Is Here,’ Says Yergin, as North American E&Ps Slammed by Coronavirus and Price War

The energy sector was quick to take a red pen to the 2020 budget in March as the coronavirus turned into a pandemic and the price war continued overseas, but some operators are finding they have to cut deeper in the face of uncertain demand for oil and gas.

NGI The Weekly Gas Market Report

‘Big Cut Is Here,’ Says Yergin, as North American E&Ps Slammed by Coronavirus and Price War

The energy sector was quick to take a red pen to the 2020 budget in March as the coronavirus turned into a pandemic and the price war continued overseas, but some operators are finding they have to cut deeper in the face of uncertain demand for oil and gas.

NGI The Weekly Gas Market Report

U.S. Rig Count Seen Dropping Further and Faster Than Previous Downturns as Covid-19, Price War Take Toll

The U.S. horizontal oil rig count is poised to drop by an estimated 65% amid the unprecedented effects of the oil price war and Covid-19pandemic, according to a new analysis by Rystad Energy.

NGI The Weekly Gas Market Report

U.S. Rig Count Seen Dropping Further and Faster Than Previous Downturns as Covid-19, Price War Take Toll

The U.S. horizontal oil rig count is poised to drop by an estimated 65% amid the unprecedented effects of the oil price war and Covid-19pandemic, according to a new analysis by Rystad Energy.

Natural Gas Futures Extend Rally as Weather Data Again Leans Colder for Mid-April

Further colder trends in the overnight weather data helped natural gas futures extend their recent run higher in early trading Tuesday. The May Nymex contract was trading 8.0 cents higher at $1.811/MMBtu at around 8:40 a.m. ET.