Further colder trends in the overnight weather data helped natural gas futures extend their recent run higher in early trading Tuesday. The May Nymex contract was trading 8.0 cents higher at $1.811/MMBtu at around 8:40 a.m. ET.

Topic / Coronavirus

SubscribeCoronavirus

Articles from Coronavirus

NGI The Weekly Gas Market Report

Coronavirus Leads ExxonMobil to Cut Capex by 30%, Impacting Permian, Rovuma LNG

ExxonMobil on Tuesday joined its oil and gas peers around the world, announcing it is reducing capital spending by 30% and trimming cash operating expenses by 15% in response to the dual challenges of an oversupplied market and demand weakness from the Covid-19 pandemic.

NGI The Weekly Gas Market Report

Coronavirus Leads ExxonMobil to Cut Capex by 30%, Impacting Permian, Rovuma LNG

ExxonMobil on Tuesday joined its oil and gas peers around the world, announcing it is reducing capital spending by 30% and trimming cash operating expenses by 15% in response to the dual challenges of an oversupplied market and demand weakness from the Covid-19 pandemic.

NGI The Weekly Gas Market Report

EIA Maintains $2.11 Henry Hub Forecast, but Warns of ‘Heightened Levels of Uncertainty’ from Coronavirus

The Energy Information Administration (EIA) said Tuesday domestic oil and natural gas production are likely to fall this year as the coronavirus takes a chunk out of demand at home and abroad, but the federal agency maintained the same gas price it forecast in March.

NGI The Weekly Gas Market Report

EIA Maintains $2.11 Henry Hub Forecast, but Warns of ‘Heightened Levels of Uncertainty’ from Coronavirus

The Energy Information Administration (EIA) said Tuesday domestic oil and natural gas production are likely to fall this year as the coronavirus takes a chunk out of demand at home and abroad, but the federal agency maintained the same gas price it forecast in March.

Athabasca Oil Mothballs Hangingstone Bitumen Production Site

Athabasca Oil Corp. has called the first halt to an entire Canadian bitumen production site in response to depressed prices and the economic contraction caused by the coronavirus pandemic.

Athabasca Oil Mothballs Hangingstone Bitumen Production Site

Athabasca Oil Corp. has called the first halt to an entire Canadian bitumen production site in response to depressed prices and the economic contraction caused by the coronavirus pandemic.

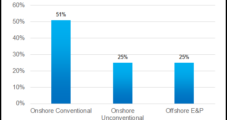

Most North American E&Ps Seen Cutting 2020 Capex by 35-40% as Coronavirus Wreaks Havoc

Pressured by global oversupply wrought by the coronavirus and the price war, most North American producers have slashed their capital spending on average by 35-40% year/year versus original guidance, but revisions globally are playing out differently, according to Evercore ISI.

Most North American E&Ps Seen Cutting 2020 Capex by 35-40% as Coronavirus Wreaks Havoc

Pressured by global oversupply wrought by the coronavirus and the price war, most North American producers have slashed their capital spending on average by 35-40% year/year versus original guidance, but revisions globally are playing out differently, according to Evercore ISI.

NGI The Weekly Gas Market Report

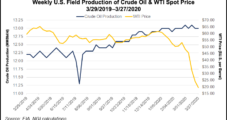

Lower 48 Shut-Ins Said Likely as E&P Capex Cuts Won’t Dent Short-Term Oversupply from Covid-19

Until people are traveling again, on the road or in the air, the economic benefits of cheap oil “remain largely theoretical,” as Covid-19’s hit to global demand is worse than the impact of the financial crisis, according to Raymond James & Associates Inc.