Until people are traveling again, on the road or in the air, the economic benefits of cheap oil “remain largely theoretical,” as Covid-19’s hit to global demand is worse than the impact of the financial crisis, according to Raymond James & Associates Inc.

Topic / Coronavirus

SubscribeCoronavirus

Articles from Coronavirus

Energy Regulators in California Race to Get Ahead of Covid-19

California energy officials indicated last Friday they are taking steps to track and mitigate the coronavirus stay-home mandates’ impact on the energy mix in the nation’s most populous state.

Energy Regulators in California Race to Get Ahead of Covid-19

California energy officials indicated last Friday they are taking steps to track and mitigate the coronavirus stay-home mandates’ impact on the energy mix in the nation’s most populous state.

NGI The Weekly Gas Market Report

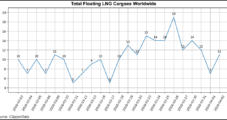

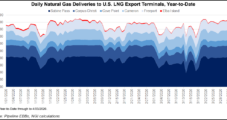

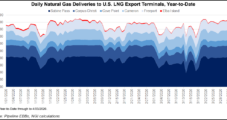

Uncertainty Reigns in Global LNG Market as Coronavirus Lockdowns Persist

Uncertainty continues to mount across the global natural gas market with key buyers from Europe to South Asia sidelined by measures to slow the coronavirus, raising questions about how suppliers across the world will respond to the possibility of an extended downturn in demand as inventories fill.

Natural Gas Futures Called Lower as Latest EIA Print Implies Covid-19 Demand Destruction

Natural gas futures were trading slightly lower early Friday as analysts found signs of Covid-19 demand destruction in the latest government inventory data. The May Nymex contract was down 1.1 cents to $1.541/MMBtu at around 8:45 a.m. ET.

Natural Gas Futures Called Lower as Latest EIA Print Implies Covid-19 Demand Destruction

Natural gas futures were trading slightly lower early Friday as analysts found signs of Covid-19 demand destruction in the latest government inventory data. The May Nymex contract was down 1.1 cents to $1.541/MMBtu at around 8:45 a.m. ET.

NGI The Weekly Gas Market Report

Greenfield Natural Gas, Oil Projects in Pre-FID ‘All At Risk’ for Deferral on Covid-19 Pandemic

The global natural gas and industry undoubtedly will see a dramatic pullback in sanctioned projects this year, with only 10 of more than 50 now in the pipeline likely to proceed, with well financed deepwater and niche liquefied natural gas (LNG) facilities the possible bets to rise above the carnage, according to Wood Mackenzie.

NGI The Weekly Gas Market Report

Greenfield Natural Gas, Oil Projects in Pre-FID ‘All At Risk’ for Deferral on Covid-19 Pandemic

The global natural gas and industry undoubtedly will see a dramatic pullback in sanctioned projects this year, with only 10 of more than 50 now in the pipeline likely to proceed, with well financed deepwater and niche liquefied natural gas (LNG) facilities the possible bets to rise above the carnage, according to Wood Mackenzie.

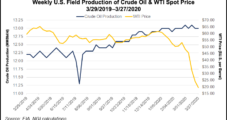

North America’s Natural Gas, Oil Capex Still Shrinking as Demand Destroyed by Oil Price War, Covid-19

The start of the second quarter has not been a good one for the oil and gas industry, as it appears no global operator will be spared from the devastating oil price war and deadly coronavirus pandemic.

North America’s Natural Gas, Oil Capex Still Shrinking as Demand Destroyed by Oil Price War, Covid-19

The start of the second quarter has not been a good one for the oil and gas industry, as it appears no global operator will be spared from the devastating oil price war and deadly coronavirus pandemic.