Interests that are long natural gas won’t have to wait too much longer for some demand dynamism to come to the gas market, according to analysts at PIRA Energy Group, which recently completed a client-sponsored study of “demand implications of the shale revolution.”

Tag / Significant

SubscribeSignificant

Articles from Significant

Pennsylvania Counties Support USGS Baseline Testing of Water Wells

Officials in two Pennsylvania counties with significant oil and gas drilling that targets the Marcellus Shale say they support plans by the U.S. Geological Survey (USGS) to conduct baseline testing at private water wells in their counties next year.

Harvard Researcher Sees U.S. as Largest Oil Producer by 2017

The United States could produce 5 million b/d from shale oil deposits by 2017 and may become the world’s largest oil producer — reaching up to 16 million b/d in just a few years by combining shale with conventional oil, liquefied natural gas (LNG) and biofuels, according to a researcher at Harvard Kennedy School.

Texas Eastern Offering Utica/Marcellus-Gulf Coast Capacity

Spectra Energy’s Texas Eastern Transmission LP is offering capacity on its Gulf Market Expansion Project, which would give Marcellus and Utica Shale gas access to growing Gulf Coast markets in Louisiana and Texas, including for future export of liquefied natural gas (LNG).

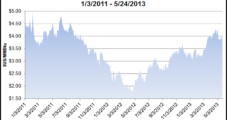

Industrial Sector Demand Priming Pump for Prices

The revival of the U.S. industrial sector will be “the most significant driver” to higher long-term natural gas prices, lifted by new ethylene crackers, ammonia plants and natural gas-to-liquids (GTL) facilities fed by stores of natural gas, according to an analysis by Raymond James & Associates Inc.

No. 1 Primer for Natural Prices: Industrial Sector Demand

The revival of the U.S. industrial sector will be “the most significant driver” to higher long-term natural gas prices, lifted by new ethylene crackers, ammonia plants and natural gas-to-liquids (GTL) facilities fed by stores of natural gas, according to an analysis by Raymond James & Associates Inc.

Industrial Sector Rocketing NatGas Prices Longterm, Says Raymond James

The revival of the U.S. industrial sector will be “the most significant driver” to higher long-term natural gas prices, lifted by new ethylene crackers, ammonia plants and natural gas-to-liquids (GTL) facilities fed by unconventional natural gas, according to an analysis by Raymond James & Associates Inc.

European Steelmaker Siting Plant in Eagle Ford Country

Cheap U.S. natural gas contributed to a decision by European steelmaker Voestalpine AG to site a new plant outside of Corpus Christi, TX.

Most U.S. Voters Found to Support Natural Gas Exports

The export of liquefied natural gas (LNG) from the United States would appear to have significant backing from American voters, according to the results of a new American Petroleum Institute (API) poll conducted by Harris Interactive.

ConocoPhillips Preps for Growth Beyond 2013

ConocoPhillips has a plan to deliver 3-5% growth in both its oil and gas volumes and its margins, but don’t look for it to happen this year.