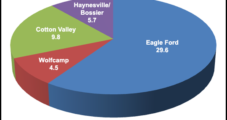

Exco Resources Inc. is paying Chesapeake Energy Corp. $1 billion for something wet and something dry: about 55,000 acres in the liquids-rich Eagle Ford Shale of Texas and about 9,600 acres in the drier Haynesville Shale in North Louisiana (see related story). The deal’s dry gas component is viewed by analysts as a steal while the Eagle Ford acreage is considered to be marginal.

Rich

Articles from Rich

Chesapeake Sells $1B in Eagle Ford, Haynesville Assets to Exco

Exco Resources Inc. is paying Chesapeake Energy Corp. $1 billion for something wet and something dry: about 55,000 acres in the liquids-rich Eagle Ford Shale of Texas and about 9,600 acres in the drier Haynesville Shale in North Louisiana.

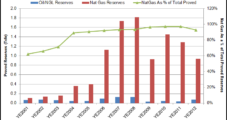

U.S. Shale Gas Lifting E&P Proven Reserves

Onshore drilling efficiencies in domestic shale gas plays continue to increase, per-unit costs continue to fall, and together, they given a big boost to operators’ proven reserves, by one calculation.

Encana U.S. Liquids Output Set to Double This Year

Liquids-rich onshore plays from a stable of better-known assets, including the San Juan Basin, and an emerging portfolio of unconventionals will “almost double” domestic liquids production this year, Encana Corp. U.S. chief Jeff Wojahn said Tuesday.

Sanchez Triples Production from Year Ago

Sanchez Energy Corp., which targets the liquids-rich Eagle Ford Shale, charted first quarter production of 355,000 boe, an increase of 106% from the fourth quarter and 320% from the year-ago period, the company said.

NuVista Taking Montney Midstream Capacity

Canadian midstream operator Keyera Corp. has agreed to transport and process the Wapiti Montney condensate-rich natural gas production of NuVista Energy Ltd.

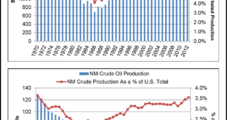

New Mexico Still Attracting Interest Despite Less Production

While Mexico’s gas-rich San Juan Basin turned up another declining year of natural gas production in 2012, state officials and some exploration and production (E&P) companies are maintaining interest in the state’s overall oil, liquids and gas businesses.

New Mexico Gas Output Drops for Sixth Year

While New Mexico’s natural gas-rich San Juan Basin turned up another declining year of natural gas production in 2012, at least one exploration and production (E&P) company is “encouraged” by results so far this year.

Despite Less Production, New Mexico Attracts Interest

While Mexico’s gas-rich San Juan Basin turned up another declining year of natural gas production in 2012, state officials and some exploration and production (E&P) companies are maintaining interest in the state’s overall oil, liquids and gas businesses.

Matador an Eagle Ford Oil Bull

Matador Resources Co., which is focused on the liquids-rich portion of the Eagle Ford Shale, grew its oil production almost eight-fold last year to just over 1.2 million bbl from 154,000 bbl in 2011 and 33,000 bbl in 2010. The company will stay focused on the Eagle Ford and growing its Permian Basin position as gas prices aren’t high enough to support more Haynesville Shale activity, CEO Joe Foran said Thursday.