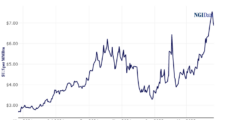

January Nymex natural gas futures extended a relief rally into the fourth trading day Monday as hints of colder January weather provided some support, but weather and fundamental outlooks suggested the upside movement would be short lived. At A Glance: Futures reverse early larger gains Supply outweighs brief weather support Cooldown helps cash mostly higher…

Forecast

Articles from Forecast

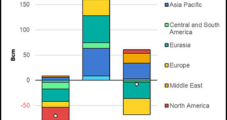

IEA Sees Growing Global Natural Gas Supply, Resilient Long-Term Demand Through 2050

The International Energy Agency (IEA) is projecting that global demand for natural gas will start to dip by the end of this decade, but should remain strong and near a historic peak through 2050. In its latest 350-page annual World Energy Outlook (WEO), researchers said that for the first time in the history of the…

El Niño Could Bring Scorching Temperatures This Summer, Boost Asian LNG Demand

The three-year La Nina that ended in March could give way to hotter temperatures in Asia this summer and boost consumption of natural gas and other fossil fuels across the region. The U.S. Climate Prediction Center last week increased the probability of El Niño weather conditions emerging between June and August to 75%. While the…

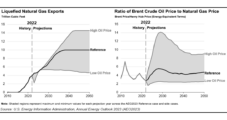

EIA Sees LNG Exports At Least Doubling by 2050 as Demand Holds Steady, Though Unknowns Abound

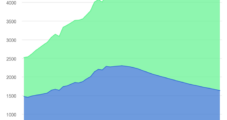

U.S. natural gas production and LNG exports are likely to grow between now and 2050 with domestic gas consumption dropping only slightly, according to the Energy Information Administration (EIA). All of the scenarios modeled in EIA’s latest Annual Energy Outlook (AEO) released Thursday show the United States remaining a net exporter of natural gas and…

Global Reshuffle Presents 2023 Opportunities for Risk-Takers in Mexico’s Natural Gas Sector

In 2023, Mexico’s natural gas industry will be shaped by public-private partnerships and the shifting landscape brought about by Russia’s invasion of Ukraine. Political risk for private and international firms, meanwhile, remains high. Last year, President Andrés Manuel López Obrador’s team said they would carry out costly infrastructure works in conjunction with the private sector.…

PJM Says Ready for Winter Energy Demand on Strengthened ‘Preparations and Processes’

PJM Interconnection LLC, which serves 65 million across the Mid-Atlantic, said it is armed to combat winter, with adequate fuel and energy supplies to meet a forecast peak demand of about 137 GW. The regional transmission operator serves customers in Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West…

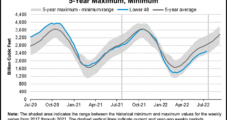

AGA Outlook Calls for Chilly Winter, but Strong Natural Gas Production to Help Balance Market

Heating demand could prove stronger this winter than last, given National Weather Service (NWS) forecasts for colder temperatures in northern markets. But robust production levels this fall should help the market meet demand and could help keep consumer prices from rising more than they already did this year. That assessment is according to the American…

U.S. Natural Gas Storage Injections Below Average Amid ‘Chillier-than-Normal’ Winter Forecast

Early 2023 could lead to more natural gas use than normal, with heavy snow predicted for two big oil and natural gas states, Oklahoma and Texas, according to the Farmers’ Almanac’s 2022-2023 Extended Winter Weather Forecast. In the recently published edition, the 200-plus-year-old periodical said it expects snow and an “active storm track” to run…

Do U.S. E&Ps Need Higher Natural Gas Prices to Offset Demand and Inflation? Yes, Says Moody’s

Natural gas development costs in the United States are rising, stung by rising consumption, inflation, supply chain issues and labor shortages, all of which are eating away at the margin, according to Moody’s Investors Service. The credit ratings agency recently hiked its medium-term Henry Hub natural gas price range by 50 cents to $2.50-$3.50/Mcf. The…

IEA Expects Global Natural Gas Demand to Drop on Ukraine War Market Disruptions

Global natural gas demand is likely to decline this year due to high prices and market disruptions caused by Russia’s invasion of Ukraine, according to the International Energy Agency (IEA). The IEA revised this year’s forecast for natural gas consumption growth in its latest quarterly report to slightly below zero from its previous estimate in…