E&P | LNG | NGI All News Access | NGI The Weekly Gas Market Report | Shale Daily

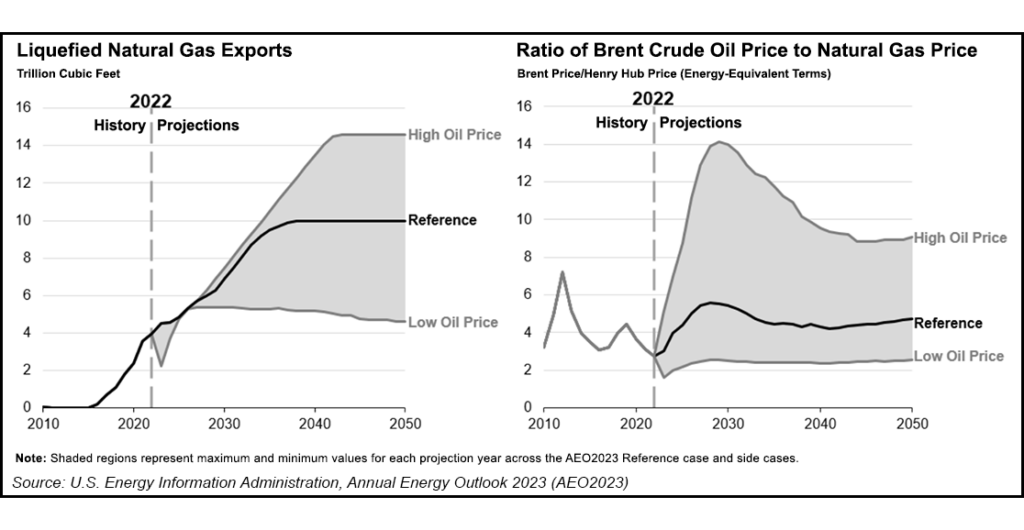

EIA Sees LNG Exports At Least Doubling by 2050 as Demand Holds Steady, Though Unknowns Abound

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |