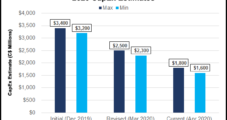

Calgary-based exploration and production (E&P) company Obsidian Energy Ltd. said Monday it would try to capitalize on higher commodity prices by spending an additional C$3.2 million ($2.5 million) in 2020 to begin drilling the first pad in its Central Alberta Willesden Green asset. Obsidian’s 2020 capital spending is set to increase to C$56 million ($43…

Capex

Articles from Capex

ExxonMobil Retreats on Spending, with ‘Significant’ Natural Gas Development Off The Table

ExxonMobil is backing off ambitious goals to increase spending and is slicing the book value of some of its assets, particularly the U.S. dry natural gas portfolio, by up to $20 billion. Following an annual strategic review by the board in late November, the Irving, TX-based energy giant on Monday said it has revised its…

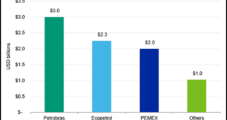

Latin American Oil, Natural Gas Companies Said Slashing Capex 30% in 2020

Latin America oil and natural gas companies will cut close to $8.3 billion in capital expenditures (capex) in 2020, or about 30% from original guidance for the year, according to Moody’s Investors Service. Brazilian national oil firm Petróleo Brasileiro SA, or Petrobras, Colombian state firm Ecopetrol SA and Mexico’s national oil company Petroleos Mexicanos (Pemex)…

Equinor Dominates in Renewable Investments While Other Oil Majors Face Capex Cuts

Over the next five years, the world’s oil majors are expected to invest up to $17.5 billion into solar and wind energy projects, a Rystad Energy analysis projected.

NGI The Weekly Gas Market Report

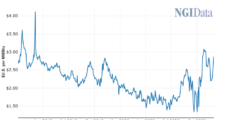

Ovintiv Keeping Eye on Natural Gas Prices as Shut-ins Reduce Output by 65,000 Boe/d

Denver-based Ovintiv Inc., whose broad oil and natural gas portfolio runs across the Permian and Anadarko basins and the Montney formation in Canada, is shelving some onshore work in the Eagle Ford, Bakken, Uinta and Duvernay formations, but it’s keeping a sharp eye on the direction of natural gas prices to determine when to boost activity.

NGI The Weekly Gas Market Report

Enterprise ‘Creating Value,’ Cutting Costs Amid Coronavirus Uncertainty

Enterprise Products Partners LP (EPD) has yet to see a “material change” to volumes across its system, but given the “highly uncertain” impacts of the coronavirus for the remainder of 2020, it has reduced planned growth capital investments by $1 billion and sustaining capital expenditures (capex) by $100 million.

NGI The Weekly Gas Market Report

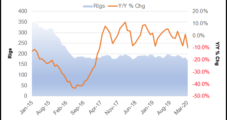

As Coronavirus Destroys Demand and Pricing, All Bets Off on Global E&P Capex, Says Raymond James

Upstream capital spending was predicted to make a bit of a comeback from 2019, but all bets are off for 2020 worldwide spending, with the United States likely to take the deepest plunge.

NGI The Weekly Gas Market Report

Pandemic Market Turmoil Set to Cut into E&P Spend South of Border

U.S. exploration and production (E&P) companies arecuttingcapital expenditure (capex) by 35-40% from 2019 as oil prices continue to get hammered and demand is destroyed by the coronavirus pandemic, but spending reductions could be even harsher south of the U.S. border.

NGI The Weekly Gas Market Report

With Demand Smothered by Covid-19, Canadian E&Ps, OFS Operators Reduce Capex, Output

A cross-section of Canadian producer and contractor firms deepened 2020 capital spending cuts Monday in response to the worsening fossil fuel market outlook caused by the Covid-19 virus pandemic.

NGI The Weekly Gas Market Report

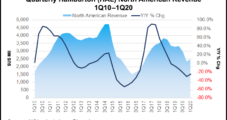

Halliburton Cuts Capex by Half, Reduces Workforce, with Bottom in 2Q

Houston-based Halliburton Co., the largest pressure pumper in the Lower 48, no longer is seeing a “flight to quality,” but a flight to anywhere, as customers deal with the Covid-19 pandemic and low commodity prices, CEO Jeff Miller said Monday.