With a vow to focus on efficiency, Suncor Energy Inc. set 2022 performance targets of 5% production growth while cutting capital expenditures by 6%. The 2022 corporate budget aims for combined oil and natural gas output of 750,000-790,000 boe/d. Spending goes down by C$300 million ($240 million) to C$4.7 billion ($3.76 billion). “We enter 2022…

Capex

Articles from Capex

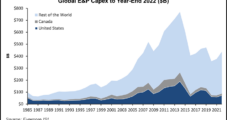

Global E&P Capex in 2022 Led by U.S. E&Ps, with Privates Playing ‘Outsized Role’

The U.S. exploration and production (E&P) sector is increasing its capital spending in 2022 for the first time in four years, while Canada is set to remain near multi-decades lows, according to Evercore ISI. Global E&P capital expenditures (capex) are poised to climb by 16% year/year (y/y) in 2022, extending 5.5% growth in 2021 “for…

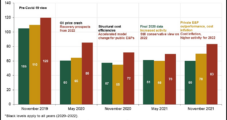

Lower 48 Oil, Gas Spending Seen Rising 19% in 2022 on Cost Inflation, Activity Uptick

Spending by Lower 48 oil and natural gas producers is set to rise by 19.4% next year to $83.4 billion from an expected $69.8 billion in 2021, according to new analysis by Rystad Energy. Service price inflation is expected to account for $9.2 billion of the spending growth, with increased activity contributing $8.6 billion, said…

ExxonMobil Steadies Capex to 2027, but Ambitions to Reduce GHG Emissions Expand

ExxonMobil plans to hold capital spending steady over the next six years for its natural gas and oil projects while bumping up expenditures for carbon-reduction projects, the supermajor said Wednesday. Annual capital expenditures (capex) are to be “held constant” at $20-25 billion, a 17-33% reduction from the $30 billion spending target set in 2019 before…

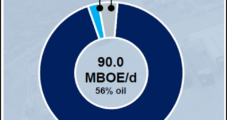

Matador Profits Soar On Higher Oil, Natural Gas Production, Prices

Matador Resources Co. nearly doubled its third quarter earnings versus the same period last year, citing improved commodity prices and operational efficiency. The Dallas-based independent operates primarily in the Permian Basin’s Delaware sub-basin, which accounted for 93% of total production in 3Q2011. Matador also operates in the Eagle Ford and Haynesville/Cotton Valley shale plays. During…

Montney Producer Advantage Energy Boosts Capex to Accelerate Drilling

Montney Shale producer Advantage Energy Ltd. is seeking to boost oil and natural gas output this winter after raising its capital spending target for 2021 amid improved commodity prices. The Calgary-based company said it was raising its capital guidance by $20 million to a range of $140 million-$150 million. Advantage plans on using the extra…

Marathon Oil Inching Up Lower 48 Production to Year’s End, but Capex Holding Steady

Marathon Oil Corp. CEO Lee Tillman promised investors during a quarterly conference call on Thursday that higher oil and natural gas prices would not move the company to increase capital spending this year. The Houston-based super independent, which has set a 2021 capital expenditure (capex) budget of $1 billion, generated $422 million of free cash…

Continental Execs Urge Discipline from Lower 48 Producers Amid High Oil, Natural Gas Prices

Lower 48 exploration and production firms must stay disciplined amid current high oil and natural gas prices, Continental Resources Inc. management said recently. “While we remain bullish on commodity prices, given the volatility of price cycles and potential impact of, and government reaction to, the Covid variants, we continue to believe it is inappropriate for…

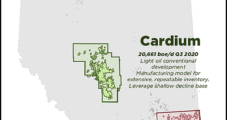

Alberta-Focused Obsidian Targeting More Wells for Oily Cardium Prospect

Calgary-based Obsidian Energy Ltd. said Tuesday it is setting aside C$35 million ($27 million) in capital expenditures (capex) for a drilling program and C$5 million ($4 million) in decommissioning expenditures for the first half of 2021. The exploration and production company plans to drill up to eight wells at the Cardium development in Willesden Green…

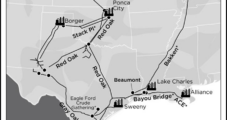

Phillips 66 Cuts 2021 Capex on Challenging Market Conditions

Houston-based energy manufacturing and logistics firm Phillips 66 is targeting a 2021 capital expenditure (capex) budget of $1.7 billion, down from $3.1 billion year/year. “Our 2021 capital budget is supported by our diversified portfolio, strong financial position and capital discipline,” said CEO Greg Garland. “We continue to focus on reducing capital expenditures as market conditions…