LNG | LNG Insight | NGI All News Access | Uncategorized

LNG Recap: Berkshire Hathaway Affiliate to Takeover Operations at Cove Point

A Berkshire Hathaway Inc. affiliate will take over operations of the Cove Point liquefied natural gas (LNG) export terminal after it agreed to acquire a 25% stake in the facility as part of a broader $9.7 billion deal to buy Dominion Energy Inc.’s natural gas transmission and storage segment.

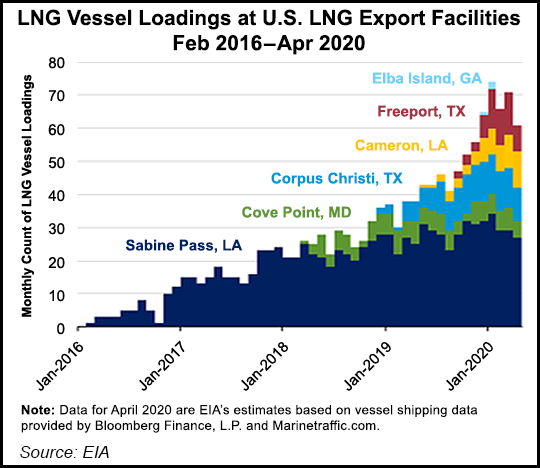

Dominion will retain a 50% passive interest in the terminal, one of six in operation across the United States that’s located on the Chesapeake Bay in Lusby, MD, south of Baltimore. Dominion is divesting the transmission and storage assets as it plans to focus entirely on its state-regulated electricity and natural gas utilities. The deal is expected to close in 4Q2020.

The sale of interest in Cove Point to Berkshire Hathaway Energy follows another late last year, when Dominion sold a 25% stake to Brookfield Asset Management Inc. in a deal valued at more than $2 billion.

Cove Point has storage capacity of 14.6 Bcf and the ability to send out 1.8 Bcf/d. It was built in the 1970s to import LNG and started exporting in April 2018.

The deal comes as the global gas market continues to face headwinds due to the Covid-19 pandemic, but is ultimately expected to continue growing in the years ahead. U.S. LNG feed gas demand dropped by more than 1 Bcf day/day on July 1 and has remained around 3 Bcf/d compared to the June average of roughly 4 Bcf/d with dozens of cargoes for July and August lifting cancelled as it remains uneconomic to move American gas overseas at current prices.

The decline in LNG feed gas demand comes as U.S. natural gas supplies continue to increase. Tudor, Pickering, Holt & Co. (TPH) said associated natural gas volumes increased by 1.5 Bcf/d last week, while overall gas volumes were up 2 Bcf/d.

“The increase in production and decrease in LNG puts the market back into an oversupply situation on a weather neutral basis, but thankfully current forecasts are very constructive of gas demand,” TPH said of the July heat that’s settled in across parts of the country.

Meanwhile, Bloomberg New Energy Finance (BNEF) warned in a note last week that if Covid-19 related energy demand loss continues, natural gas imports could fall by 1.1% to 5.3% this year. If the virus continues to prove resurgent, import declines could persist into 2024, with demand in the emerging markets of south and southeast Asia likely to see the biggest hits if pipeline and regasification infrastructure is delayed, BNEF said.

In other international developments, regulators in Denmark on Monday cleared the Nord Stream 2 (NS2) pipeline project to move ahead with work on the last 100-mile stretch of the system in Danish waters. The Danish Energy Agency cleared the Gazprom-led project to use pipe-laying vessels with anchors instead of those that use more complex self-positioning technology that were targeted by U.S. sanctions.

Work on the pipeline stopped in December after U.S. sanctions forced privately-held Allseas to suspend underwater pipe-laying activities in the Baltic Sea. The 1.9 Tcf/year NS2 would export gas from Russia to Europe across the Baltic Sea, terminating in Germany near the existing Nord Stream pipeline that follows a similar path. The Trump administration has resisted the project as it promotes U.S. LNG imports in the region and works to curb Russia’s economic influence there.

Elsewhere, shippers and traders that have booked capacity at a critical outlet to move gas from Slovakia to Ukraine this summer are likely to face steep costs. Ukrtransgaz needs to conduct unexpected maintenance from August through October on the Budnice interconnection, which had threatened to stop flows. The European gas market has increasingly utilized Ukranian storage facilities as others on the continent are filling.

While Slovakia’s system operator will offer capacity at another exit point, Velke Kapusany, Slovakian regulators rejected two solutions put forward by the Ukranian system operator to cut costs associated with the maintenance outage. Slovakia’s URSO said it would not allow shippers to transfer the capacity they booked on Budince to Velke Kapusany free of charge, or virtually merge the two points during maintenance.

European inventories continued to fill over the weekend as storage was at more than 81% of capacity on Saturday. Ukraninan storage was at 62% of capacity the same day, according to the latest available data.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |