NGI The Weekly Gas Market Report | Infrastructure | LNG | LNG Insight | NGI All News Access

U.S. Lawmakers Push More Nord Stream 2 Sanctions as Russia Searches for Workarounds

U.S. lawmakers have introduced bipartisan legislation to expand sanctions targeting the Nord Stream 2 (NS2) natural gas pipeline as Russia pushes ahead to complete the project and move more supplies into Europe.

Sens. Ted Cruz (R-TX) and Jeanne Shaheen (D-NH) introduced the bill Thursday, which would modify legislation they sponsored last year that was signed into law by President Trump as part of the annual defense bill. The new measures would expand sanctions to cover any entity that aids NS2’s completion.

“There’s a bipartisan and bicameral consensus that Russia’s Nord Stream 2 pipeline poses a critical threat to America’s national security and must not be completed,” Cruz said. Sens. John Barrasso (R-WY), Tom Cotton (R-AR) and Ron Johnson (R-WI) joined Cruz and Shaheen in introducing the bill.

Cruz noted that Russia continues to try to circumvent the sanctions put in place last December, which forced privately held Allseas to suspend underwater pipe laying activities in the Baltic Sea, leaving only 100 miles left to go. “This new bill will once and for all clarify that those involved in any way with installing pipeline for the project will face crippling and immediate American sanctions,” he said.

The new legislation would cover any related services for underwater pipeline construction and make the new sanctions immediate. Specifically, they would apply to vessels engaged in pipe laying activities, as well as those that provide vessels to do so, and ultimately to any company that provides certification for Nord Stream to begin operations.

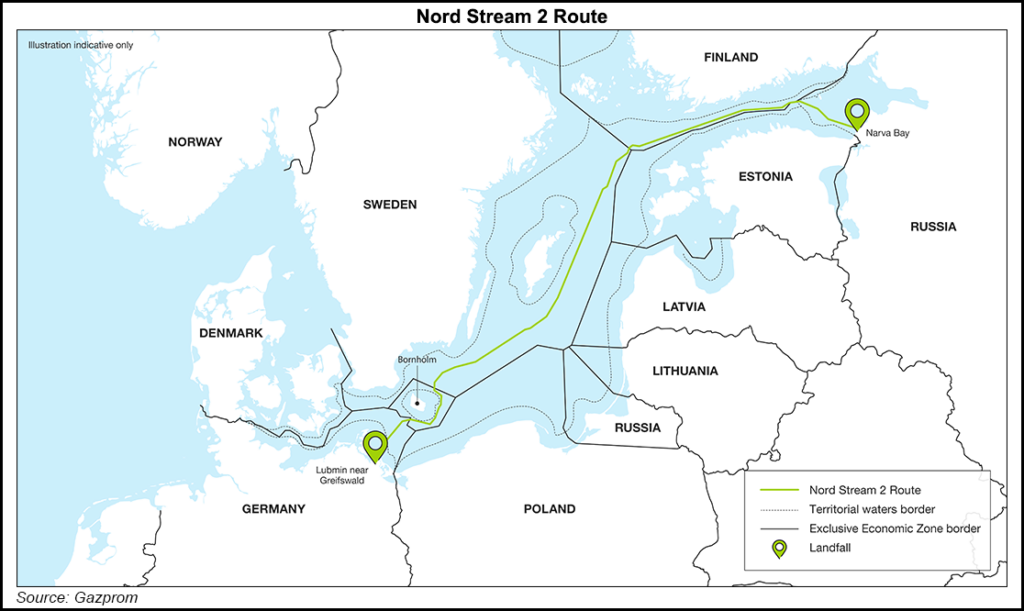

The Gazprom-led, 1.9 Tcf/year NS2 would export gas from Russia to Europe across the Baltic Sea, terminating in Germany near the existing Nord Stream pipeline that follows a similar path. Gazprom provided more than one-third of Europe’s natural gas in 2018, supplying 200.8 billion cubic meters (Bcm). According to BP plc’s latest Statistical Review of World Energy, Europe consumed 549 Bcm in 2018.

The United States has pursued policies to reduce Europe’s dependence on Russian gas, promoting the availability of U.S. liquefied natural gas (LNG) for the continent, which has taken in an increasing amount of the super-chilled fuel from producers across the world. European gas imports hit record highs last year and have continued climbing as the continent soaks up the globe’s excess supplies.

To be sure, Europe has been a top market for U.S. LNG, with 114 of the 209 cargoes that had been exported by the end of May having gone to the continent, according to NGI calculations. Those supplies have helped diversify volumes and cut the cost of natural gas in Western Europe, while they’ve reduced Russia’s role as the dominant supplier in other parts of the region.

Last year’s sanctions have been “very effective already, as they have stopped NS2 in its tracks,” said Anna Mikulska, a nonresident fellow in energy studies at Rice University’s Baker Institute for Public Policy. She told NGI that expanding the sanctions would be likely to exacerbate problems for the project and lead to even more costly delays.

Mikulska, whose research focuses on the geopolitics of natural gas within the European Union (EU), added that it’s likely Russia will try to finish the project despite the sanctions. She also said Russian gas would continue to flow to Europe regardless of NS2 or measures to diminish its role in the region.

As Russia works through other issues such as regulatory hurdles in the EU, it has already brought in the Akademik Cherskiy, a Russian-flagged pipeline laying vessel to finish work that remains on hold.

Clearview Energy Partners LLC said in a note to clients on Thursday that the new legislation could clear congress this year, but that might take time. The firm noted that there’s a risk NS2 could be completed before sanctions are expanded, especially if “election-year partisanship” makes passage difficult.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |