Berkshire Hathaway may own more than one-quarter of Occidental Petroleum Corp. (Oxy), but the giant investment firm has no plans to take over, Chairman Warren Buffett said. Oxy is an investment “that we expect to maintain indefinitely,” Buffett stated In his annual letter to shareholders. At the end of 2023, Berkshire owned 27.8% of Oxy’s…

Berkshire

Articles from Berkshire

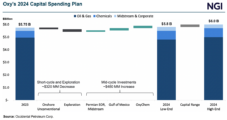

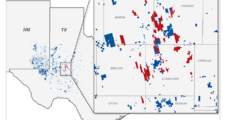

Oxy Joining Permian M&A Fray with $12B CrownRock Acquisition

Occidental Petroleum Corp. (Oxy) has agreed to acquire privately held Permian Basin oil and natural gas producer CrownRock L.P. in a deal valued at roughly $12 billion. Oxy plans to finance the acquisition by incurring $9.1 billion in new debt, issuing about $1.7 billion of common equity and assuming CrownRock’s $1.2 billion of existing debt,…

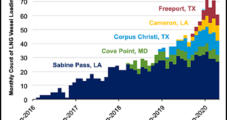

Berkshire Pays $3.3B to Gain 75% Stake in Cove Point LNG Terminal

An affiliate of Warren Buffett’s Berkshire Hathaway Inc. has agreed to boost its ownership stake in the Cove Point LNG export terminal in Lusby, MD, to 75% in a deal valued at $3.3 billion. Berkshire Hathaway Energy (BHE) said it would purchase Dominion Energy Inc.’s 50% stake, leaving Brookfield Infrastructure Partners with 25% interest in…

Berkshire Hathaway Ups Oil, Natural Gas Holdings with $6B Investment in Japanese Trading Houses

An affiliate of Warren Buffet’s Berkshire Hathaway Inc. said Monday that it has taken stakes in five of Japan’s biggest trading companies, which have significant oil and natural gas holdings worldwide. Subsidiary National Indemnity Company has acquired more than 5% of the outstanding shares of Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co. and…

LNG Recap: Berkshire Hathaway Affiliate to Takeover Operations at Cove Point

A Berkshire Hathaway Inc. affiliate will take over operations of the Cove Point liquefied natural gas (LNG) export terminal after it agreed to acquire a 25% stake in the facility as part of a broader $9.7 billion deal to buy Dominion Energy Inc.’s natural gas transmission and storage segment. Dominion will retain a 50% passive…

Oxy’s Anadarko Purchase Questioned by Icahn, Who Threatens Board Fight

Calling the takeover of Anadarko Petroleum Corp. overpriced and misguided, activist investor Carl Icahn, who holds an estimated $1.6 billion (5%) stake in Occidental Petroleum Corp. (Oxy), is suing the company and threatening a fight for control of the board.

NGI The Weekly Gas Market Report

Berkshire Hathaway Commits $10B to Help Oxy Take Anadarko

Berkshire Hathaway Inc. agreed Tuesday to invest up to $10 billion in Occidental Petroleum Corp. (Oxy) to help the independent usurp Chevron Corp.’s bid to buy Anadarko Petroleum Corp.

Sempra Trumps Suitors with $9.45B Offer for Oncor

Natural gas-focused San Diego-based Sempra Energy made a late bid that allowed it to pluck off bankruptcy-bound Energy Future Holdings Corp. (EFH), the indirect owner of 80% of Texas-based Oncor Electric Delivery Co., for $9.45 billion in cash, topping one by Warren Buffett’s Berkshire Hathaway conglomerate.

Fire Destroys Lubrizol Oilfield Chemistry Facility in Pennsylvania

An oilfield chemistry facility owned by Berkshire Hathaway Inc.’s Lubrizol Corp. was destroyed by a fire on Tuesday in Southwest Pennsylvania. Eight people, including firefighters and Lubrizol employees, were treated for non-life threatening injuries.

Berkshire Hathaway Builds Stake in Phillips 66

Warren Buffett’s Berkshire Hathaway Inc. on Friday disclosed a near-11% stake worth $4.48 billion in Phillips 66, improving its bet on growth in U.S. pipelines and onshore liquids.