SLB Ltd. expects the international offshore oil and natural gas industry to surge through this decade, CEO Olivier Le Peuch said Friday. The No. 1 oilfield services company saw its highest year/year revenue growth in three years in the second quarter of 2023, even amidst a cooling of activity in its North America exploration and…

Tag / International

SubscribeInternational

Articles from International

Schlumberger Sees Ongoing ‘Resilient’ Upstream Growth in North America, Elsewhere

Constrained availability of oilfield services (OFS) supply capacity in North America, and increasingly internationally, rank among ongoing “tailwinds” for natural gas and oil prices, management at Schlumberger Ltd. said Friday. The OFS giant sees “a decoupling of upstream spending from potential near-term demand volatility, resulting in resilient global oil and gas activity growth in 2022…

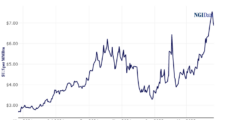

Do U.S. E&Ps Need Higher Natural Gas Prices to Offset Demand and Inflation? Yes, Says Moody’s

Natural gas development costs in the United States are rising, stung by rising consumption, inflation, supply chain issues and labor shortages, all of which are eating away at the margin, according to Moody’s Investors Service. The credit ratings agency recently hiked its medium-term Henry Hub natural gas price range by 50 cents to $2.50-$3.50/Mcf. The…

BC Reaches Deal to Compensate Blueberry First Nations, Preserve Natural Gas Projects

Compensation payments of C$65 million ($52 million) will save 195 shale gas and forestry projects affected by a June 29 Indigenous rights court verdict in northern British Columbia (BC), in an agreement between the tribal case winner and the provincial government. To salvage projects approved before the verdict, the deal announced Thursday (Oct. 7) commits…

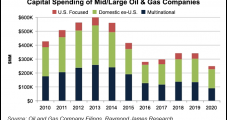

U.S. E&Ps Reining in Capex, while International Operators Spending More

U.S. oil and gas producers are likely to reduce their capital spending this year by around 8% as they remain “extremely disciplined, yes, really,” based on a global survey by Raymond James & Associates Inc. Analysts Pavel Molchanov, John Freeman and Graham Price compiled the 2021 projections in the firm’s eighth annual capital expenditure (capex)…

Noble Energy Shareholders Say Yes to Chevron Marriage

Shareholders of Houston-based Noble Energy Inc. on Friday approved a pending merger with Chevron Corp. in a special meeting, all but guaranteeing the tie up will be completed by year’s end. Chevron in July clinched a definitive agreement in an all-stock transaction worth $5 billion that carried a total enterprise value, including debt, of $13…

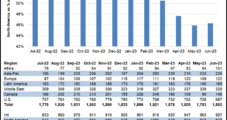

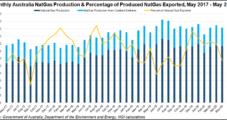

Australian Natural Gas Auctions Said Competitive Even as Bigger Players Dominate

Spot prices in Eastern Australia’s domestic natural gas auctions generally are close to marginal supply prices even though three large firms dominate the markets, according to a market expert. Regulated auctions with bids and offers set the daily prices for wholesale gas in four eastern Australian markets, with prices typically a netback to Asian liquefied…

Chevron’s $13B Deal for Noble to Add Lower 48 Heft, Natural Gas Promise in Offshore Eastern Med, Equatorial Guinea

Chevron Corp. has clinched a definitive agreement to acquire Houston super independent Noble Energy Inc. in an all-stock transaction worth $5 billion that carries a total enterprise value, including debt, of $13 billion. The transaction, which values Noble at $10.38/share, would trade 0.1191 Chevron shares for each Noble share. Noble’s massive natural gas operation offshore…

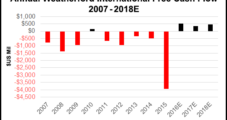

Weatherford Boosts 2016 Cash Flow Estimates on Reduced Overhead, Efficiencies

Weatherford International plc, working overtime to overcome a string of poor quarterly performances, this year expects to generate cash flow well above forecasts after reining in costs and bringing in more cash than it spent in 2015 for the first time in five years.

NGI The Weekly Gas Market Report

U.S. LNG Exports to Boost Trading Flexibility, Says IEA

The global natural gas trade should increase much more rapidly than pipeline gas over the next 25 years, with U.S. gas exports helping to diversify the market and make trading more flexible, the International Energy Agency (IEA) said Tuesday.