NGI Archives | NGI All News Access

Hess to Spend 40% of E&P Budget on U.S. Shale Prospects

Hess Corp. said Wednesday it plans to spend $6.8 billion on capital expenditures (capex) in 2013, with the largest share — $2.7 billion, or 40% of the exploration and production (E&P) budget of $6.7 billion — devoted to unconventional resources.

Specifically, the New York City-based oil major said the $2.7 billion will go toward developing assets in North Dakota’s Bakken Shale and for drilling appraisal wells in an Ohio section of the Utica Shale. Global E&P President Greg Hill said Hess will spend $2.2 billion in the Bakken this year, down from close to $3.1 billion spent in the play in 2012.

“This reduced level of spend is driven by lower well costs associated with our transition to pad drilling from hold by production mode and decreased investments in infrastructure projects,” Hill said. “In addition, we plan to increase our expenditures in the emerging Utica Shale play to $400 million from $300 million last year.”

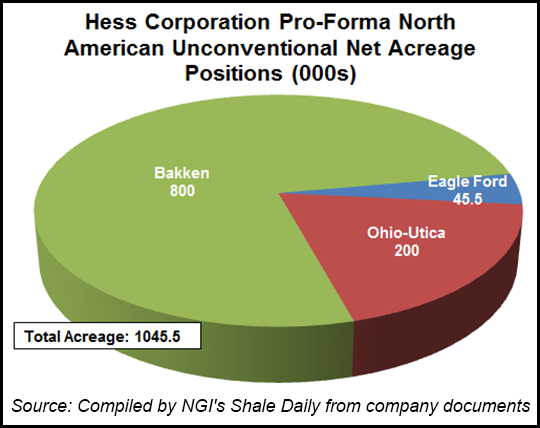

Hess holds 800,000 net acres in the Bakken, making it the second-largest leaseholder in the play behind Continental Resources Inc.’s 984,000 net acres. Company reports show Hess also holds about 200,000 net acres in the Utica (see Shale Daily, Dec. 5, 2012; Aug. 16, 2012).

The company plans to operate 14 rigs in the Bakken this year, down from the 16 rigs in the play in mid-December (see Shale Daily, Dec. 20, 2012).

Hess plans to spend the remainder of the 2013 E&P budget on conventional resources, with $1.85 billion (28%) allocated to production, $1.6 billion (24%) for development and $550 million (8%) devoted to exploration. Another $100 million would be spent on marketing, refining and corporate expenses. In last year’s budget, Hess originally set aside nearly 37% of the $6.8 billion capex budget on shale plays, specifically the Bakken, Eagle Ford and Utica (see Shale Daily, Jan. 17, 2012).

Hess has been acquiring unconventional acreage for the last two years. In September 2011, the company acquired almost 185,000 net acres in the Utica and more than 18,000 undeveloped net acres in Louisiana’s Haynesville Shale after agreeing to buy Marquette Exploration LLC for $750 million (see Shale Daily, Sept. 9, 2011). The company also agreed to pay Consol Energy Inc. $593 million to acquire a half interest in nearly 200,000 net acres in eastern Ohio (see Shale Daily, Sept. 8, 2011). Two years ago Hess paid $1.05 billion in cash to acquire 167,000 net acres in the Bakken from TRZ Energy LLC, which moved into second place acreage-wise (see Shale Daily, Dec. 30, 2010).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |