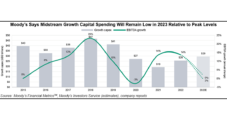

The global midstream energy industry is likely to expand only modestly through 2023 and next year, given slumping natural gas prices and stubbornly high inflation, according to Moody’s Investors Service. The rating agency’s research arm, in a new outlook, emphasized the modest growth would follow strong performances across 2022, a year in which energy demand…

Capital

Articles from Capital

Chevron Updates 2050 Net-Zero Targets, Sees Australian LNG a Keeper Longer Term

Chevron Corp. is aiming by 2050 to reach net-zero carbon in its equity upstream operations, with more capital set to be poured into alternative energies and improved efficiencies across the traditional global oil and natural gas businesses. The San Ramon, CA-based integrated major has adopted a net-zero pledge within 30 years for Scope 1 (direct)…

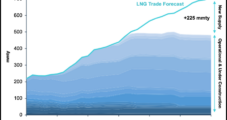

Cheniere Eyes 2022 to Sanction Corpus Christi LNG Stage 3

Cheniere Energy Inc. said Tuesday it expects to take a final investment decision (FID) next year for the Stage 3 expansion at its Corpus Christi liquefied natural gas (LNG) export terminal in South Texas. Executives said the Houston operator is focused on lining up commercial contracts for the expansion, which could add more than 10…

MPLX’s 2021 Capex Lower, Preparing for Long Post-Covid Recovery

The Marcellus Shale and Permian Basin remain growth areas for MPLX LP, but the operator plans to put more of an emphasis on “strict” capital and cost discipline going forward as uncertainty regarding the Covid-19 pandemic lingers. CEO Michael Hennigan said the midstream giant is targeting only $800 million in growth capital spending in 2021,…

4Q2019 Earnings: PDC to Cut More Costs, Reduce DJ Basin, Permian Activity in 2020

PDC Energy Inc.’s oil and gas sales declined last year as commodity prices fell, offsetting a 23% increase in year/year production and a 22% annual decline in total costs.

Permian Still Hot, but Slumping Lower 48 M&A Market Looking to Rebound in 2020

Following an overall paltry return for Lower 48 oil and gas property sales in 2019, the dealmaking market may be looking for a repeat, as well-financed operators prowl for quality assets at bargain prices, according to energy data specialist Enverus.

Chevron Lifting Permian Spend but Appalachia Shale Shunned on Natural Gas Price Slump

Chevron Corp. is raising capital spending in the Permian Basin by around 11% for the coming year, but Appalachia is to see budget cutbacks on the continued slump in natural gas prices.

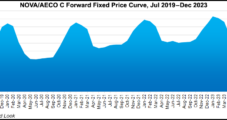

ARC Resources Cuts Capex, Defers BC Natural Gas Project on Low Commodity Prices

Low commodity prices have led Alberta-based Arc Resources Ltd. to slash capital spending and defer a British Columbia (BC) natural gas processing project for at least a year.

Development Capital Scores JV to Explore Permian Wolfcamp

A Development Capital Resources LLC (DCR) subsidiary said Wednesday it is partnering in the Permian Basin via a $165 million joint venture (JV) to target oil and gas in the Wolfcamp formation.

Encana’s Anadarko Basin Well Costs Cut $1M Since Mid-February, Says CEO

Encana Corp.’s well costs in the Anadarko Basin have fallen by about $1 million since it completed the Newfield Exploration Co. merger in February, with a “line of sight to significantly more savings” in the months ahead, the Calgary-based independent said Tuesday.