CNX Resources Corp. announced Friday that it would assume full ownership of Cone Midstream Partners LP after entering an agreement with Noble Energy Inc. to acquire its remaining interest in the system for $305 million in cash.

Consol

Articles from Consol

Consol Set to Unleash Appalachian NatGas Production As Coal Split Moves Forward

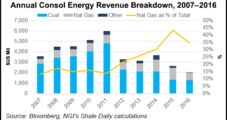

Consol Energy Inc. announced Tuesday that with final approval from its board, it expects to split into two separate companiesnext month, with the natural gas and coal businesses trading separately beginning Nov. 29.

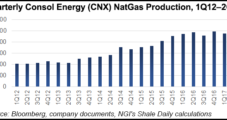

Consol Reports Strong 3Q Production in Preliminary Estimates

Consol Energy Inc. said Monday it produced between 99 and 103 Bcfe during the third quarter, according to preliminary estimates filed with the U.S. Securities and Exchange Commission (SEC) as part of its plans to spin off its remaining coal assets into a separate publicly traded company by year’s end.

Operational Issues Force Consol to Lower Oil/NatGas Production Guidance

Consol Energy Inc. announced Tuesday that it has lowered 2017 exploration and production (E&P) division guidance to 405-415 Bcfe from the previous range of 420-440 Bcfe, citing a variety of reasons for the reduction.

Consol Hits Snags in Utica; Production Declines

Consol Energy Inc. had problems at two Utica Shale pads in southeast Ohio during the second quarter that led to significant turn-in-line (TIL) delays and only six wells coming online, which reduced year/year production by 7%.

Consol to Spin Off Remaining Coal Assets, Rebrand As NatGas-Focused E&P

After years of working to rebuild the core of its business to evolve around natural gas production, Consol Energy Inc. said Tuesday that a subsidiary has filed a registration statement with the Securities and Exchange Commission to spin-off its remaining coal assets into a separate publicly-traded company.

Consol Energy On Track to Divest Up to $300M of Noncore Assets By Mid-Year

While it has sold billions of dollars of coal assets in the last five years, an improving commodity price environment and the recent dissolution of a Marcellus Shale joint venture (JV) allowed Consol Energy Inc. to recently close on three noncore exploration and production (E&P) asset sales for $108 million.

Briefs — Vesta Midstream

Tulsa-based Vesta Midstream Partners LLC said it plans to design and construct its Oil City Gathering and Processing System in Carter County, OK, to offer low- and high-pressure gas gathering and processing services to wells in the South Central Oklahoma Oil Province (aka, the SCOOP). “Anchored by a long-term producer contract with a significant acreage dedication, Vesta is well-positioned to provide a broad spectrum of midstream services to producers in the SCOOP and STACK [the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties] areas,” Vesta said. “As the company begins construction and works to meet the needs of its producer customers, Vesta will also consider projects in other oil and gas basins as well.” Vesta formed recently with private-equity backing from Dallas-based Energy Spectrum Partners VII LP.

Consol Focused on Building Utica Core in Coming Years

Consol Energy Inc. outlined plans this week to fold more Utica Shale into its core position through a development program to increase stacked pay opportunities and build on its current 22-year drilling inventory.

Consol, Noble Drop NatGas Pipeline Assets to Cone Midstream After JV Split

Cone Midstream Partners LP said Wednesday it has agreed to acquire the remaining interest in more than 125 miles of pipelines and 650 MMcf/d of natural gas compression capacity from sponsors Consol Energy Inc. and Noble Energy Inc. in a deal valued at $248 million.