EQT Corp. and Range Resources Corp. on Tuesday rebuffed an investment firm’s end-of-the-year pitch urging the companies to merge in a deal that it argued would create “the largest and best-positioned natural gas producer in the United States.”

Corp

Articles from Corp

Briefs — Chesapeake

Chesapeake Energy Corp. was rejected again in its bid to avoid paying investors in a bond dispute after the U.S. Court of Appeals for the Second Circuit held for the plaintiff. In a 3-0 ruling the circuit court said the $438.7 million payout, which includes a make-whole payment of $380 million and interest, was justified because Chesapeake waited too long to tell bondholders about a plan to redeem $1.3B of of debt six years early [Chesapeake Energy Corp. v. Bank of New York Mellon Trust Co. NA, No. 15-2366-cv]. The company in February 2012 issued senior notes due on March 15, 2019. On February 20, 2013 Chesapeake said it would redeem the notes, but the Bank of New York Mellon Corp. sued, claiming the time to give notice of redemption at the special price had expired. Under terms of the agreement, Chesapeake had to give 30 days notice, which ended March 15, 2013, less than 30 days before it planned to redeem the bonds. The U.S. District Court for the Southern District of New York in 2015 had ruled for the bank (see Shale Daily,July 10, 2015).

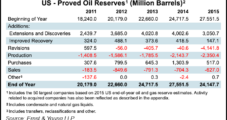

‘Staggering’ U.S. E&P Reserve Revisions in 2015 Eliminated 40 Tcf, 4.1 Billion Bbl

The 50 largest U.S. producers last year saw their revenues and capital spending plunge, as they attempted to cope in the first full year since 2004 that West Texas Intermediate oil spot prices averaged under $60/bbl, Ernst & Young LLP said.

ExxonMobil, Chevron, Phillips 66 in Top 10 of Fortune 500

Three of the top 10 U.S. companies in the Fortune 500 listing for 2015 are directly involved in natural gas and oil production — No. 2 ExxonMobil Corp., No. 3 Chevron Corp. and No. 7 Phillips 66 — and two more are big contributors to the domestic energy sector, No. 4 Berkshire Hathaway and No. 8 General Electric.

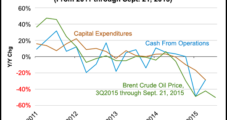

Global Oil/Gas Companies Show ‘Wide Deficit’ of Operating Cash to Capex

Despite cuts in capital expenditures (capex), oil and natural gas producers worldwide are seeing greater declines in their operating cash flow and, consequently, lower cash balances, trends that could continue into 3Q2015 if crude oil prices continue to fall, the U.S. Energy Information Administration (EIA) said.

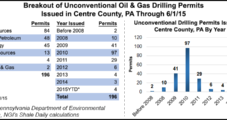

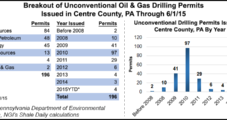

Larger NatGas Gathering System On Track For Central Pennsylvania

After years of planning, Unit Corp. subsidiary Superior Appalachian Pipeline LLC is on track to complete one of central Pennsylvania's larger gathering systems to move Marcellus Shale gas to Dominion Transmission Inc.

Larger NatGas Gathering System On Track For Central Pennsylvania

After years of planning, Unit Corp. subsidiary Superior Appalachian Pipeline LLC is on track to complete one of central Pennsylvania’s larger gathering systems to move Marcellus Shale gas to Dominion Transmission Inc.

Redraw U.S. Energy Policy For Newfound NatGas, Oil Landscape, Says Tillerson

U.S. energy policies should heed the country’s new era of natural gas and oil abundance with an overhaul to make them less burdensome and more transparent, ExxonMobil Corp.’s chief said Thursday in Washington, DC.

‘More Assertive’ Industry Voices Needed in Carbon Debate, Says Shell CEO

Critics may prefer natural gas and oil be left in the ground, but renewables aren’t yet able to take over and “provoking a sudden death of fossil fuels isn’t a plausible plan,” Royal Dutch Shell plc’s chief said Thursday.

Producers Sway Top 20 in Fortune Global 500

The latest Fortune Global 500 for 2014 again is weighted to oil and natural gas producers, with China strengthening from a year ago.