Under Shadow of Coronavirus, LNG Woes Weigh Down August Natural Gas Futures Despite Positive Storage Report

A favorable storage report was overshadowed on Thursday by a coronavirus resurgence and its potential to keep liquefied natural gas (LNG) exports at depressed levels. The August Nymex contract lost 5.5 cents day/day and settled at $1.723/MMBtu. September fell 4.2 cents to $1.776.

NGI’s Spot Gas National Avg. advanced 1.0 cents to $1.680.

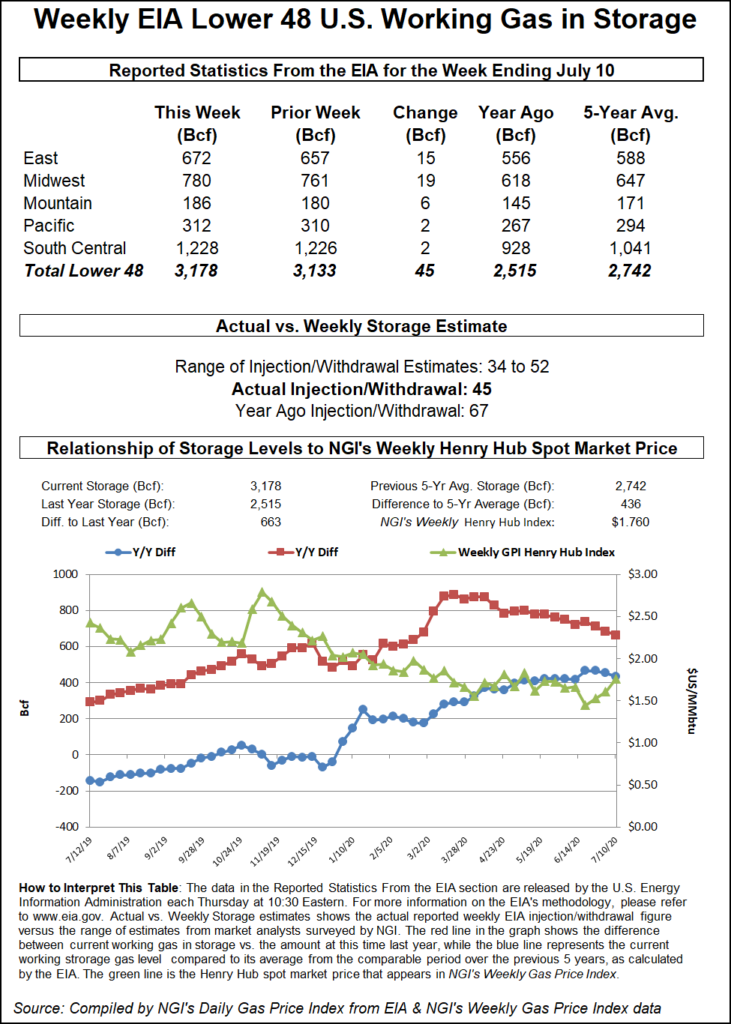

The U.S. Energy Information Administration (EIA) reported an injection of 45 Bcf for the week ending July 10, the third straight week of double-digit injections and affirmation that scorching summer heat is driving energy needs and helping to align gas supply and demand.

The build was lower than the 56 Bcf injection for the week ended July 3 and slightly below analysts’ average expectations. A Bloomberg survey prior to the report found injection estimates ranging from 38 Bcf to 50 Bcf, with a median of 47 Bcf. A Reuters poll showed a low estimate of 34 Bcf and a high of 52 Bcf with an average of 47 Bcf. NGI estimated an injection of 49 Bcf.

The latest result compares with a 67 Bcf storage build in the same week in 2019 and a five-year average injection of 63 Bcf.

While cooling demand is robust amid July heat levels that could set records, analysts said LNG concerns fester because exports likely will be needed to prop up demand once the sizzling summer temperatures subside.

Even with the recent progress, stockpiles are high. The 45 Bcf build lifted inventories to 3,178 Bcf, well above the year-earlier level of 2,515 Bcf and above the five-year average of 2,742 Bcf.

“Clearly, weak LNG and hefty supplies are weighing more heavily than above-normal July temperatures,” NatGasWeather said after EIA issued the latest report.

The virus continues to dampen demand for domestic exports and subdue weather-driven momentum. Since early June, cooling-degree days have run above average and forecasts, while tempering some in recent days, continue to call for strong heat into August. Still, LNG feed gas levels remain subdued as the virus surges, hindering industrial and commercial demand in key export destinations across Europe and Asia.

“LNG feed gas demand continues to come in at very low levels in July,” Genscape Inc. analyst Eric Fell said Thursday on The Desk’s online energy platform Enelyst.

“We are modeling record power demand for July driven by much hotter-than-normal temps — close to the all-time record in 2011– and the lowest July gas prices in 10-plus years,” Fell added. However, risks to “LNG demand are very high” as signs of increased production start to emerge and as the depth and duration of the public health crisis, as well as its impact on domestic and foreign economies, grows increasingly uncertain with widespread virus outbreaks late in June into July.

Genscape said production Thursday hovered near 87 Bcf/d, marking seven consecutive days at around that level. Lower 48 production bottomed at 84.9 Bcf/d on May 20, the firm said, and production levels have ranged from 85.5 Bcf/d to 88.5 Bcf/d since then.

Production has come back gradually as oil producers, benefiting from a modest recovery in crude prices, reopen wells and generate associated gas. Still, absent prolonged heat waves ahead of the shift to winter, containment issues could surface in the fall without some recovery in LNG demand.

That, however, remains highly dependent on a pandemic that shows few signs of abating in the United States and across much of the globe. Without notably slower spread of the virus, economies will remain under pressure and industrial energy demand will likely remain weak relative to pre-pandemic levels, Raymond James & Associates Inc. chief economist Scott Brown told NGI.

“Demand is not going to snap back any time soon — at least until the outbreaks are better controlled,” Brown said.

Cash Climbs

Spot gas prices advanced Thursday amid the continued heat and widespread cooling needs.

NatGasWeather said the Global Forecast System (GFS) model has been “slowly giving back demand” over the past 24 hours but that the European model showed the opposite.

“Both still forecast a hotter-than-normal pattern through the end of the month into early August, but with the European model stronger and hotter with the upper ridge next week and beyond,” the forecaster said. “To our view, the GFS is likely too cool and the European model slightly too hot.”

Bespoke Weather Services said it “sided with the cooler solution, given how the medium range has been forecast too hot rather consistently in recent weeks.” However, “the pattern is still a hot one, consistently running above normal even with the cooler trends as things progress forward, so it is not a bearish pattern by any means.”

Bottom line, the firm said, searing temperatures are likely to persist throughout July and deep into summer.

Gainers on Thursday included PG&E Citygate, up 8.0 cents day/day to average $2.490, and OGT, ahead 4.0 cents to $1.640. Kern Delivery rose 3.0 cents to $1.840.Decliners included PNGTS, down 2.0 cents to $2.475, and Consumers Energy, off 3.5 cents to $1.700.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |