Nearly In-Line Storage Injection a Drag on August Natural Gas Futures

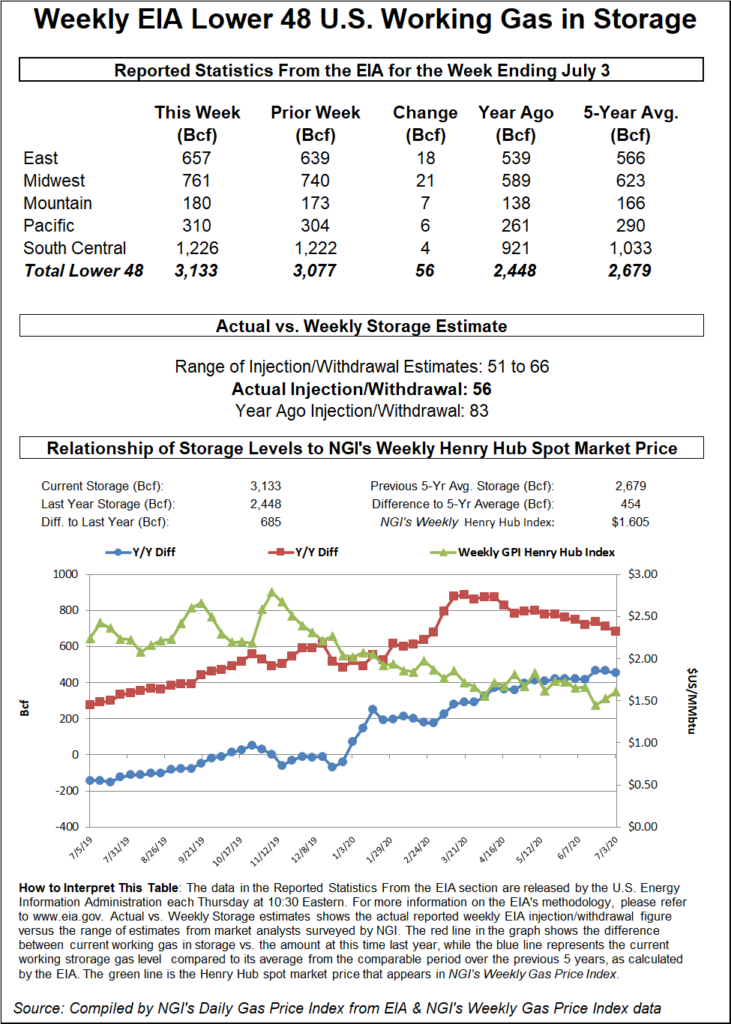

The U.S. Energy Information Administration (EIA) reported an injection of 56 Bcf into natural gas storage for the week ending July 3, coming in slightly below average estimates and nudging Nymex natural gas futures lower.

Analysts said the latest injection signals that demand, boosted by scorching summer heat that is driving energy use for cooling, is realigning with supply after months of imbalance imposed by the coronavirus pandemic and the related slump in economic activity.

But they emphasized that the improvement is gradual and still highly dependent on continued lofty temperatures to offset commercial and industrial demand – both domestic and abroad — that is still light relative to pre-pandemic levels.

“We’re slowly eating away” at the year/year surplus, said one participant on The Desk’s online energy platform Enelyst. “Still a long way to go, but lots of heat in the forecast for the balance of July.”

The latest weather models showed a “solidly hot U.S. pattern” over the next 15 days, particularly for the period starting next Thursday and extending through July 23, NatGasWeather said Thursday. The forecaster expects strong heat for the balance of the summer.

Ahead of the EIA report, the August contract was up nearly 4.8 cents at $1.872/MMBtu, and the prompt month ticked up further to around $1.873 when the EIA data was released. By 11 a.m. ET, however, the August contract gave up the early gains and was trading at $1.822.

Prior to the report, a Bloomberg survey found injection estimates ranging from 55 Bcf to 62 Bcf, with a median of 59 Bcf. The average of a Wall Street Journal poll was 57 Bcf, with a low estimate of 51 Bcf and a high of 63 Bcf. A Reuters poll found estimates ranging from 51 Bcf to 65 Bcf and an average of 58 Bcf. NGI estimated an injection of 66 Bcf.

Bespoke Weather Services said continued robust weather is also needed to offset anemic liquefied natural gas (LNG) export levels. The pandemic depleted European and Asian demand for U.S. exports.

“Balance-wise, this is a strong number, in our view, in terms of what is needed to avoid containment” in the fall, Bespoke said of the 56 bcf injection. “But we need to sustain a strong weather pattern to continue offsetting the impact of very low LNG volumes, which are likely here to stay for awhile.”

The latest result compares with an 83 Bcf storage build in the same week in 2019 and a five-year average injection of 68 Bcf. EIA last Thursday reported a 65 Bcf injection for the week ended June 26.

The build for the July 3 week lifted inventories to 3,133 Bcf, well above the year-earlier level of 2,448 Bcf and above the five-year average of 2,679 Bcf.

By region, the Midwest and East led with builds of 21 Bcf and 18 Bcf, respectively, according to EIA. Mountain region stocks rose by 7 Bcf, while Pacific inventories grew by 6 Bcf

The South Central build of 4 Bcf included an 8 Bcf injection into nonsalt facilities and a withdrawal of 4 Bcf from salts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |