Nearly In-Line Storage Injection Nudges July Natural Gas Futures Higher

The U.S. Energy Information Administration (EIA) reported an injection of 45 Bcf into storage for the week ending July 10, a print that reflected intense heat and robust cooling demand. The result pushed up Nymex natural gas futures, though early gains were modest amid lingering concerns about weak liquefied natural gas (LNG) demand.

The build kept inventories far above average levels, but it was lower than the 56 Bcf injection for the week ended July 3 and marked the third consecutive week of builds well below 100 Bcf.

“It was hotter than normal over most of the country” during the covered week, NatGasWeather said.

Ahead of the EIA report, the July contract was down three-tenths of a cent at $1.775/MMBtu. The prompt month recovered ground to around $1.801 when the EIA data was released. By 11 a.m. ET, the July contract was trading at $1.794, ahead 1.6 cents from Wednesday’s close.

The latest injection was slightly below mid-range market estimates. The injection “has to be viewed as a neutral number given uncertainty around how much holiday impact was in the number,” said Bespoke Weather Services, referring to the three-day Fourth of July weekend.

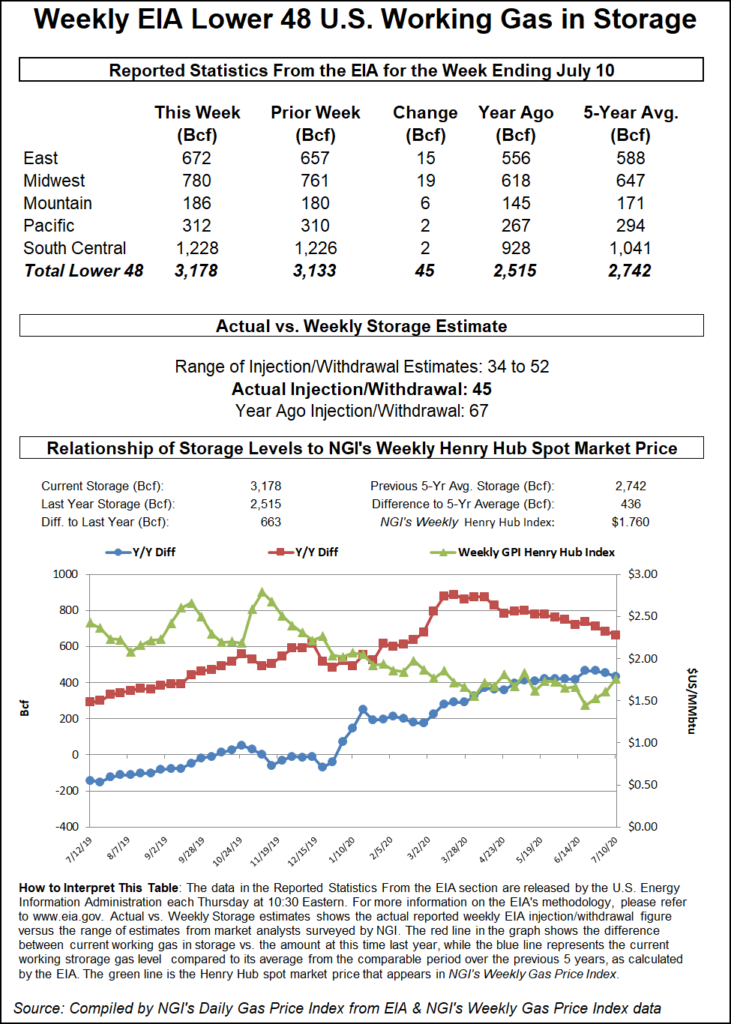

A Bloomberg survey prior to the report found injection estimates ranging from 38 Bcf to 50 Bcf, with a median of 47 Bcf. A Reuters poll showed a low estimate of 34 Bcf and a high of 52 Bcf with an average of 47 Bcf. NGI estimated an injection of 49 Bcf.

Observers said the latest injection points to recovering energy use amid the lofty summer temperatures, rather than a resurgence in commercial and industrial demand amid increased economic activity. New coronavirus outbreaks have in recent weeks further interrupted energy demand, which was already depressed relative to pre-pandemic levels.

The virus continues to weigh down demand for U.S. LNG exports, which has countered weather-driven rallies.

While cooling-degree days are running above average since the start of June, LNG feed gas levels remain very low moving into the second half of July. “LNG really needs to help out here,” said one participant on The Desk’s online energy platform Enelyst.

The latest EIA injection number compares with a 67 Bcf storage build in the same week in 2019 and a five-year average injection of 63 Bcf.

The 45 Bcf build lifted inventories to 3,178 Bcf, well above the year-earlier level of 2,515 Bcf and above the five-year average of 2,742 Bcf.

By region, the Midwest and East led with builds of 19 Bcf and 15 Bcf, respectively, according to EIA. The Mountain build of 6 Bcf was next, followed by builds of 2 Bcf in both the Pacific and South Central regions. The South Central build included a 7 Bcf injection into nonsalt facilities and a 5 Bcf withdrawal from salts.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |