The Amigo liquefaction project planned in western Mexico has been positively impacted by the Biden administration’s pause on new U.S. LNG export permits, according to LNG Alliance CEO Mutthu Chezhian. LNG Alliance is developing the Amigo LNG project at the port of Guaymas in Sonora on Mexico’s Pacific coast. The Amigo project would include a…

LNG

Articles from LNG

House Takes Export Pause Debate to Heart of Gulf Coast LNG to Hear Concerns

House Republicans are refining their arguments about the impact of the Department of Energy’s (DOE) pause on new LNG export permits, this time focusing on the Gulf Coast economies of Texas and Louisiana. Members of the Energy, Climate and Grid Security Subcommittee met in Port Arthur, TX southeast of Houston, for a field hearing focused…

ExxonMobil, Shell Cite Weaker Natural Gas Prices in 1Q Previews

ExxonMobil profits for the first three months of this year are expected to dip sharply year/year and be down sequentially in part because of weak natural gas and oil prices, the integrated major said. Shell plc also has revised its expectations. In a Securities and Exchange Commission Form 8-K filing, ExxonMobil noted that commodity prices…

DOE Insists LNG Pause Could End Within One Year in Rehearing Denials

Natural gas trade associations and LNG project developers could be forced to rely on the courts or Congress for a swift end to the U.S. Department of Energy’s (DOE) pause on new export authorizations after the agency closed the door on revisiting its decision. At the end of March, DOE issued two denials of requests…

April Natural Gas Bidweek Prices Trip Lower as Spring Season Deflates Demand

Natural gas prices were modestly lower in April bidweek trading as the transition from winter to spring signaled milder weather, weakening demand and an end-of-season natural gas supply swelling to the brim. NGI’s April Bidweek National Avg. fell 19.5 cents month/month to $1.310/MMBtu. That was down from $2.180 a year earlier. Trading for the latest…

Will Summer Temps Move U.S. Natural Gas Demand? Wind, Solar May Have a Word

Natural gas production cuts have stabilized the fuel’s prices by countering weak Lower 48 winter demand, turning the market’s attention to the next big levers for fundamentals: the upcoming summer and added wind and solar capacity. Prompt-month New York Mercantile Exchange futures, trading above the $1.800 level at the start of April, had settled as…

April Bidweek Trading Concludes as Hefty Storage, Incoming Weak Demand Weigh

Stout storage levels at the start of the weak spring demand season kept baseload natural gas prices for April under pressure in bidweek trading Tuesday, according to NGI’s Bidweek Alert (BWA). Overall trade slowed from Monday on the third and last day of bidweek trading for April baseload flows, with the Midwest and Appalachia leading…

Is U.S. Natural Gas Rig Count Rebound Unfolding? Look to Second Half of ‘24, Say Experts

Energy operators were cautiously optimistic during their recent quarterly conference calls that Lower 48 natural gas activity would improve in anticipation of increasing LNG demand, but the startup of more export projects is not yet a certainty, according to some analysts. Evercore ISI’s James West, senior managing director, said the U.S. gas rig count jumped…

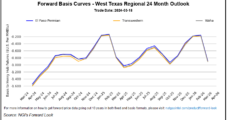

North American Natural Gas Prices Look for Support Amid U.S. LNG Permit Freeze – Mexico Spotlight

North American natural gas prices were subdued this week despite a boost from lower production and some lingering cold weather. On Thursday, the New York Mercantile Exchange contract for April settled at $1.683/MMBtu, down 1.6 cents on the day. As a comparison, NGI’s next-day Henry Hub traded Wednesday for Thursday delivery at $1.565, down a…

April Natural Gas Futures Extend Gains Bolstered by Cold Weather; Cash Climbs

April Nymex natural gas futures extended gains Tuesday with bulls feeding on near-term weather forecasts that would support a bump in demand and a pullback in the widening of natural gas storage surpluses. At A Glance: Futures add 4.1 cents Cold weather supports Texas cash still negative The front-month contract settled 4.1 cents higher at…