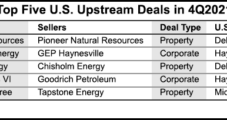

The Permian Basin and natural gas-rich Haynesville Shale accounted for nearly all of the upstream transactions in the final three months of 2021, but dealmaking overall was down sharply from the third quarter, Enverus reported. The value of Lower 48 merger and acquisition (M&A) activity between exploration and production (E&P) companies totaled $9 billion in…

Mergers

Articles from Mergers

ProFrac, FTS Merging to Create Huge U.S. Pressure Pumping Business

Privately held ProFrac Holdings LLC has clinched an all-cash agreement worth around $407.5 million to absorb FTS International Inc., which could create one of the largest pressure pumping companies focused in the Lower 48. ProFrac, based in Willow Park, TX, was formed in May 2016 by CEO Ladd Wilks and his brother Matthew Wilks, who…

Cimarex, Cabot Complete Merger, Rebrand as Coterra Energy

U.S. independents Cimarex Energy Co. and Cabot Oil & Gas Corp. have completed their closely watched merger, bringing together more than 700,000 net acres across the Marcellus Shale and the Permian and Anadarko Basins. The previously announced transaction was completed on Friday after both companies’ shareholders approved it earlier this week. The combined company operates…

U.S. Oil, Natural Gas M&A on Torrid Pace in 2Q, while Canada Led International Dealmaking

After a cold start to the year, North American upstream merger and acquisition (M&A) activity heated up in the second quarter, with U.S. dealmaking alone hitting more than 40 deals valued at around $33 billion. Energy data analytics expert Enverus on Monday issued its 2Q2021 report on U.S. exploration and production (E&P) activity. Finbrook Pte…

Texas E&Ps Independence, Contango to Merge in All-Stock Deal, Pursue Lower 48 Growth

Texas-based exploration and production (E&P) firms Independence Energy LLC and Contango Oil & Gas Co. announced Tuesday they will merge in an all-stock transaction. The E&Ps produced a combined 111,000 boe/d of oil and gas in the first quarter across several major Lower 48 basins. Houston-based Independence is owned and managed by global investment firm…

Pioneer Natural Building Permian Midland Stronghold with $6.4B DoublePoint Deal

Dallas-based Pioneer Natural Resources Co., whose focus has long been in the Permian Basin Midland, is plunking down $6.4 billion to build its base with the takeover of West Texas competitor DoublePoint Energy LLC. The deal, a cash-and-stock split, would add 97,000 net contiguous acres directly offsetting and overlapping Pioneer’s existing footprint. The mostly undrilled…

North America Again Tops Global Energy M&A

Oil and natural gas mergers and acquisitions (M&A) “slowed dramatically” in the first three months of this year from 2012, with activity slipping about 40% from the full-year 2012 average and inventory down by almost one-third, according to PLS Inc. However, as it has been for a few years, North America continued to draw the most interest and the most dollars, pulling in close to two-thirds of the transactions by dollar value and almost 80% of the total deals.

North America M&A Leads Global Markets in First Quarter

Oil and natural gas mergers and acquisitions (M&A) “slowed dramatically” in the first three months of this year from 2012, with activity slipping about 40% from the full-year 2012 average and inventory down by almost one-third, according to PLS Inc. However, as it has been for a few years, North America continued to draw the most interest and the most dollars, pulling in close to two-thirds of the transactions by dollar value and almost 80% of the total deals.

MDU Resources Ties Growth to Bakken Boom

Bismarck, ND-based MDU Resources Group is aligning its utility, construction, midstream infrastructure and exploration/production (E&P) businesses so each one profits and grows with the continuing hydrocarbon boom in the Bakken, the MDU senior executives emphasized in a half-day financial analysts meeting Thursday in New York City.

Marcellus, Utica Drew Fewer Buyers, Sellers in 2012

The Marcellus and Utica shales aren’t drawing near the attention they have been, according to a review of 4Q2012 mergers and transactions (M&A) in the United States by PwC US.