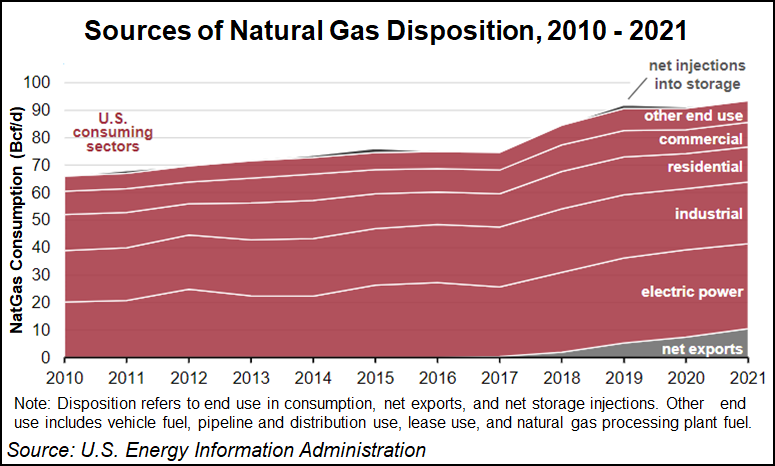

Consumption in the domestic electric and residential sectors fell in 2021, but record LNG exports drove growth in net natural gas disposition, according to the U.S. Energy Information Administration (EIA).

Natural gas demand, net liquefied natural gas exports and net storage grew by 3.6% last year compared with 2020, when the Covid-19 pandemic swept across the world. LNG exports are expected to continue to rise, EIA said, as the United States is likely to maintain its role as a top exporter.

Wood Mackenzie analysts agree that domestic LNG exports are going to surge.

“As Europe diversifies to more secure supply sources and international buyers across the globe seek reliable low cost supply, North America is poised to deliver,” said Wood Mackenzie’s Dulles Wang,...