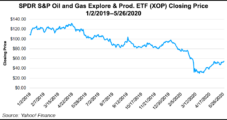

Dealmaking in the United States within the upstream oil and gas sector staged a slight recovery in the second quarter, with three of five deals in Appalachia, but the period still ranks as the third lowest in quarterly value since 2009, according to Enverus. The data analytics company in its summary of 2Q2020 U.S. upstream…

M&A

Articles from M&A

Hilcorp Taking Over BP’s Legacy Alaska Upstream Portfolio

Houston’s Hilcorp Energy Co. has completed a takeover of BP plc’s upstream portfolio in Alaska and is nearing a handoff of the midstream unit, allowing the private explorer to become one of the state’s biggest operators. The $5.6 billion deal struck last year with BP hands affiliate Hilcorp Alaska immediate control of BP Exploration (Alaska)…

BP Strikes $5B Deal to Sell Petrochemicals Business to Ineos as Energy Transition Escalates

BP plc on Monday announced it is selling off its substantial petrochemicals business, much of it in the United States, in a $5 billion deal with chemicals giant Ineos Group. The sale, designed as “the next strategic step in reinventing BP,” would strengthen the balance sheet and deliver on the supermajor’s $15 billion total planned…

NGI The Weekly Gas Market Report

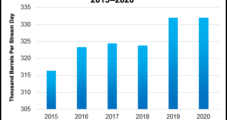

Global Oil, Gas Investments Facing ‘Unparalleled Decline,’ with Shale, Tight Resource Funding Slumping Sharply

The Covid-19 crisis, unsurprisingly, has caused global energy investments to fall more than ever, with “serious implications” for security and the transition to alternative fuels, the International Energy Agency (IEA) said Wednesday.

NGI The Weekly Gas Market Report

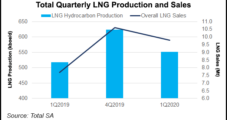

Total Strengthens European LNG Demand with Acquisition in Spain

Total SA is strengthening its hand in Europe and folding in more demand for its robust liquefied natural gas (LNG) assets in a deal to acquire 2.5 million customer contracts in Spain from utility Energias de Portugal (EDP).

NGI The Weekly Gas Market Report

Facing Cash Crunch, LNG Developer Sells Interest in Magnolia Export Project

LNG Ltd. (LNGL) said Tuesday it plans to sell its interest in a proposed liquefied natural gas (LNG) export project in Lake Charles, LA, to Global Energy Megatrend Ltd. for $2.25 million.

NGI The Weekly Gas Market Report

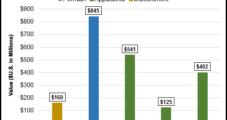

NFG Tacking On Shell’s Appalachian Natural Gas Assets for $541M; Cracker Not Included

Royal Dutch Shell plc late Monday agreed to take $541 million from National Fuel Gas Co. (NFG) for its upstream and midstream portfolio in Pennsylvania.

NGI The Weekly Gas Market Report

BP, Hilcorp Revamp $5.6B Alaska Sale on Decline in Oil Prices, Market Volatility

BP plc still expects to offload its legacy Alaska portfolio to Houston-based Hilcorp Energy Co., but terms of the $5.6 billion agreement have been renegotiated in response to market volatility.

NGI The Weekly Gas Market Report

Scuttled Deal May Threaten Magnolia, Bear Head LNG Projects

LNG Ltd. (LNGL), which is developing natural gas export terminals on the Gulf Coast and in Canada, is facing a cash crunch and warned Tuesday that it might not be in business much longer after a Singapore-based company backed out of a deal to acquire it.

NGI The Weekly Gas Market Report

Scuttled Deal May Threaten Magnolia, Bear Head LNG Projects

LNG Ltd. (LNGL), which is developing natural gas export terminals on the Gulf Coast and in Canada, is facing a cash crunch and warned Tuesday that it might not be in business much longer after a Singapore-based company backed out of a deal to acquire it.