NGI The Weekly Gas Market Report | E&P | Infrastructure | M&A | NGI All News Access

BP, Hilcorp Revamp $5.6B Alaska Sale on Decline in Oil Prices, Market Volatility

BP plc still expects to offload its legacy Alaska portfolio to Houston-based Hilcorp Energy Co., but terms of the $5.6 billion agreement have been renegotiated in response to market volatility.

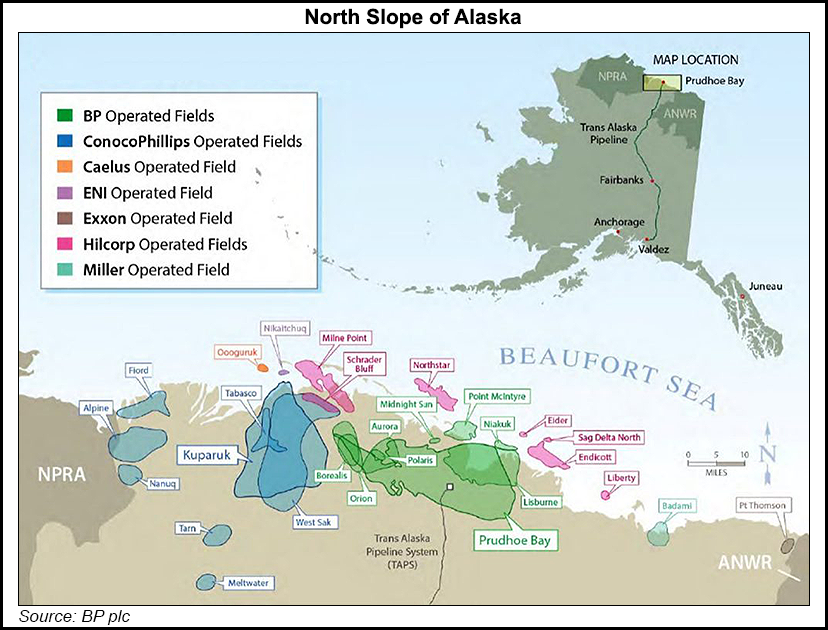

Hilcorp, one of the largest private exploration and production companies in the country and a big investor in Alaska, last August agreed to take over the massive BP operations in the state. The deal includes the entire upstream and midstream business, including BP Exploration (Alaska) Inc., which owns all of the upstream oil and gas interests, and BP Pipelines (Alaska) Inc.’s stake in the Trans Alaska Pipeline System, aka TAPS.

The transaction is expected to be completed in June. However, “reflecting recent significant market volatility and oil price falls,” the parties revamped the financial terms.

“We have worked closely with Hilcorp to reconfirm our commitment to completing this deal,” said BP’s William Lin, COO of Upstream. “The agreed revisions respond to market conditions while retaining the overall consideration. We look forward to progressing swiftly to completion and for Hilcorp to take over the operation of this important business. We are confident that completion of this sale is the right thing for both parties, for the business and for Alaska.”

Under the revised agreement, the sale price remains unchanged but the structure of payments has been modified. Originally, Hilcorp was to pay $4 billion near term and $1.6 billion through an earnout thereafter. Hilcorp had paid BP a $500 million deposit when the transaction was signed last year.

Under the revamp, the deal has lower completion payments in 2020, new cash flow sharing arrangements over the near term, interest-bearing vendor financing and, potentially, an increase in the proportion of the consideration subject to earnout arrangements.

“The revised agreement is expected to maintain the majority of the value of the transaction,” BP said. “It is also structured with flexibility to phase and manage payments to accommodate current and potential future volatility in oil prices.”

The parties also have developed a transition plan “to deliver a smooth handover of operations upon completion to allow Hilcorp to focus on embedding planned operating efficiencies as rapidly as possible.”

BP, which is scheduled to issue its first quarter results on Tuesday, noted that the Hilcorp transaction is part of its divestment program to deliver $15 billion by mid-2021.

BP had more than $20 billion in cash at the end of 2019, and it has an undrawn $8 billion revolver, which means there is no “immediate need for the cash,” analysts with Tudor, Pickering, Holt & Co. said Monday.

Still, “Hilcorp’s ability to finance any significant near-term payment is likely to continue to draw questions,” analysts said, “as the company originally wished to fund the deal entirely with debt, which seems challenging in a seized up junk market and the company’s publicly traded debt trading at 52-57 cents.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |