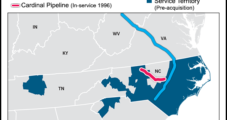

Duke Energy Corp.’s bid to purchase Piedmont Natural Gas Co. would give it and Dominion Resources Inc. a larger stake in the $4.5 billion Atlantic Coast Pipeline (ACP), which is being designed to ship more Appalachian natural gas to the Southeast.

M&A

Articles from M&A

NGI The Weekly Gas Market Report

Sempra: Full Speed Ahead on LNG, Mexico Project, But Defers on MLP Formation

San Diego-based Sempra Energy senior officials said Tuesday they are moving ahead on plans for expanding liquefied natural gas (LNG) exports from the Gulf Coast and building more infrastructure in Mexico. But previous plans for creating a master limited partnership (MLP) around some of the company’s profitable assets (see Daily GPI,June 17) have been put on hold due to unfavorable market conditions.

U.S. Midstream Dominates M&A in 3Q, While Shale Transactions Decline, Says PwC

Midstream megadeals dominated U.S. oil and natural gas transactions during the third quarter, despite the slowdown in capital markets, PwC US reported Wednesday.

NGI The Weekly Gas Market Report

$6.7B Duke-Piedmont Deal Continues ‘Power Buys Gas’ Theme

Duke Energy plans to buy its Charlotte, NC, neighbor and Atlantic Coast Pipeline project partner Piedmont Natural Gas in a $4.9 billion cash deal that it said would give it “a growing natural gas platform.” Including debt, the value of the deal is $6.7 billion.

NGI The Weekly Gas Market Report

Spectra, Phillips 66 Bolster DCP Midstream in Cash And Asset Deal Valued at $3B

Six weeks after unveiling a plan to help DCP Midstream LLC (DCP) weather low commodity prices, Spectra Energy Corp. has agreed to acquire a one-third stake in two natural gas liquids (NGL) pipelines from its master limited partnership, while Phillips 66 (PSX) has agreed to contribute $1.5 billion in cash to DCP.

North American E&Ps Spurning IPOs, MLPs

North American oil and natural gas companies, particularly the producers, turned their backs on public launches of new ventures during the third quarter, likely because of low commodity prices and potential interest rate hikes, a review of third quarter activity found.

ExxonMobil, Chevron, Phillips 66 in Top 10 of Fortune 500

Three of the top 10 U.S. companies in the Fortune 500 listing for 2015 are directly involved in natural gas and oil production — No. 2 ExxonMobil Corp., No. 3 Chevron Corp. and No. 7 Phillips 66 — and two more are big contributors to the domestic energy sector, No. 4 Berkshire Hathaway and No. 8 General Electric.

$6.8B Exelon-Pepco Merger Back On Track in DC

Exelon Corp. and Pepco Holdings Inc. (PHI) have reached a settlement agreement with District of Columbia (DC) opponents to their planned merger.

Exelon, Pepco Appeal District of Columbia Merger Denial

Pepco Holdings Inc. (PHI) and Exelon Corp. have asked the Public Service Commission of the District of Columbia (PSC) to reconsider its denial of authorization for their planned merger.

Energy Transfer-Williams Combo to Make ‘Top-Five’ Global Energy Company

Energy Transfer Equity LP (ETE) and The Williams Companies Inc. plan to merge in a $37.7 billion deal, including debt, to make what they say will be the third-largest energy franchise in North America and a top-five global energy company.