M&A | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Energy Transfer-Williams Combo to Make ‘Top-Five’ Global Energy Company

Energy Transfer Equity LP (ETE) and The Williams Companies Inc. plan to merge in a $37.7 billion deal, including debt, to make what they say will be the third-largest energy franchise in North America and a top-five global energy company.

Williams and Williams Partners LP have scrapped their merger agreement, which was a condition for the larger deal set by Energy Transfer. Energy Transfer approached Williams with an unsolicited offer earlier this year and was rejected (see Daily GPI, June 22).

During a conference call to discuss the transaction, Energy Transfer’s Jamie Welch, group CFO and head of business development, said the combined companies will have an enterprise value of about $150 billion.

“This transactional combination will take us into every basin,” Welch told analysts. “It gives us every type of hydrocarbon and every type of midstream service offering that we can provide producers across this country.

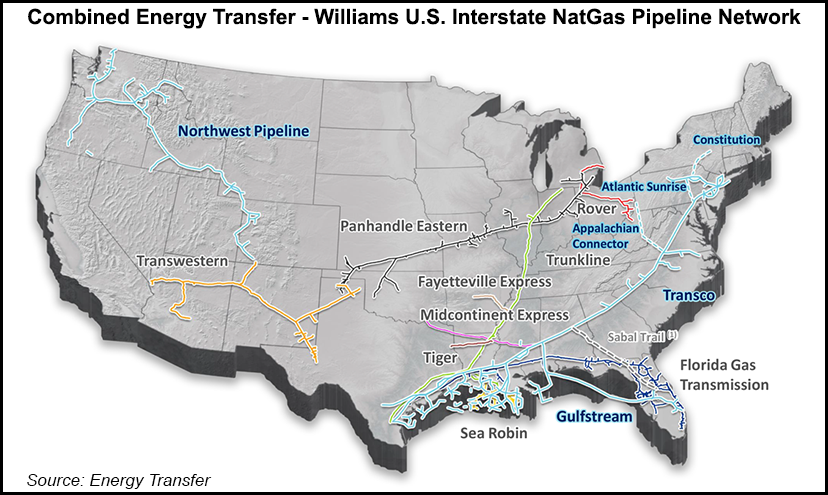

“This is a natural gas highway system designed to benefit producers and end-user customers: the connectivity of things like [Energy Transfer’s planned Rover Pipeline into [Williams’] Appalachian Connector; the ability to capitalize on [Energy Transfer’s] Trunkline and Panhandle [Transmission systems] with Transco [Williams’ Transcontinental Gas Pipeline]; the connectivity of [Williams’] Northwest Pipeline with [Energy Transfer’s] Transwestern. It goes on and on.”

Williams CEO Alan Armstrong said the combination will have better growth prospects and access to more diverse markets. Williams Partners will keep its name and remain a Tulsa, OK-based partnership.

Newly created ETE affiliate Energy Transfer Corp. LP (ETC) will acquire Williams at an implied current price of $43.50/share. Williams stockholders may take cash and/or ETC common shares. In addition, Williams stockholders will be entitled to a special one-time dividend of 10 cents per Williams share prior to the closing of the transaction. The deal is expected to be tax-free to Williams stockholders, except with respect to any cash received.

“After a comprehensive evaluation of strategic alternatives, including extensive discussions with numerous parties [see Daily GPI, July 17], the Williams board of directors concluded that a merger with Energy Transfer Equity is in the best interests of Williams’ stockholders and all of our other stakeholders,” said Williams Chairman Frank T. MacInnis. “The merger provides Williams stockholders with compelling value today as well as the opportunity to benefit from enhanced growth projects.”

All stakeholders will benefit from cash flow diversification through ownership of three investment-grade master limited partnerships (MLP) (Energy Transfer Partners LP, Sunoco Logistics Partners LP and Williams Partners), the companies said. “I believe that the combination of Williams and ETE will create substantial value for both companies’ stakeholders that would not be realized otherwise,” said ETE Chairman Kelcy Warren.

Williams’ preeminent asset is the Transco pipeline, which is the country’s largest-volume interstate gas pipeline system, according to the company, running nearly 1,800 miles between South Texas and New York City.

The Williams portfolio also includes the Gulfstream pipeline, which carries gas across the Gulf of Mexico to Florida. Additionally, Williams controls processing plants, pipelines and floating production platforms along the Gulf Coast.

Of great importance to ETE will be the assets Williams holds in the northeastern United States.

Williams’ Susquehanna Supply Hub is being built to serve gas producers in northeastern Pennsylvania. The system has a gathering inlet capacity of about 1 Bcf/d and is connected to three major interstate gas pipeline systems. The Susquehanna Supply Hub is expected to be capable of delivering more than 3 Bcf/d of Marcellus Shale production into four major interstate gas pipeline systems.

The Ohio Valley Midstream system in northern West Virginia, southwestern Pennsylvania and eastern Ohio is in the natural gas liquids (NGL)-rich heart of the Marcellus. Assets include a gathering system and a processing facility. Fractionation and additional processing facilities are under construction, with plans to add NGL pipelines, according to the company’s website.

Williams’ Laurel Mountain Midstream joint venture in southwestern Pennsylvania includes nearly 1,400 miles of pipeline with average throughput of 200 MMcf/d. Williams Partners owns 51% and operates the system. Chevron is the joint venture partner and owns the remaining 49%.

In the West, Williams has gas gathering and processing operations in Colorado, Wyoming and the Four Corners area, in addition to its Northwest Pipeline interstate gas transmission system.

Then there is the Overland Pass Pipeline, a 760-mile NGL system from Opal, WY, to the Midcontinent NGL market center in Conway, KS. The company’s facilities at Conway include more than 21 million bbl of storage for ethane, propane, butane, natural gasoline and naphtha. The company provides fractionation services in Kansas, Louisiana and Western Canada. There is also an olefins plant in Geismar, LA.

Energy Transfer’s natural gas operations include about 33,000 miles of pipelines; 154 Bcf of gas storage capacity; multiple processing, treating, conditioning and storage facilities, and four NGL facilities. Intrastate transportation and storage assets include about 7,800 miles of gas pipelines and three Texas storage facilities with 74.4 Bcf of working capacity. Interstate gas assets include 18,000 miles of pipelines, one storage facility and a liquefied natural gas (LNG) receipt terminal in Lake Charles, LA, where there are plans to add liquefaction and export capability. The NGL transportation and services segment includes about 2,300 miles of pipeline, as well as four processing plants and 48 million bbl of storage capacity.

The company’s proposed Rover Pipeline would carry gas from processing facilities in the Marcellus/Utica shale region to market hubs that have access to the Midwest, Gulf Coast, Canada and the U.S. Northeast.

During the conference call, Welch said the combination also has substantial impact for the NGL businesses.

“We will have a fully integrated liquids platform. It is not secret that we’ve obviously spent an inordinate amount of capital and investment, financial and mental acumen in developing our overall NGL business in Mont Belvieu [TX]. The rate of growth of that business has been breathtaking,” he said. “We have now focused more recently on development of the Northeast and in particular are working in conjunction with [Sunoco Logistics] on our Mariner East and Mariner West system…

“This is all about alleviating bottlenecks, taking us into places that we don’t currently have a beach head…We will not only be able to increase the movement through our NGL system at Mont Belvieu, but also we will now get connectivity in a much larger context into the Rockies and also into the Northeast with the Williams existing business.”

ETE said it expects that the earnings before interest, taxes, depreciation and amortization (EBITDA) from commercial synergies will exceed $2 billion per year by 2020 (or more than 20% of the estimated current pro forma EBITDA for the combined company) and will require overall incremental capital investment of more than $5 billion to achieve.

Closing is subject to antitrust and other customary conditions and is expected to be completed during the first half of next year. No ETE unitholder vote is required. Planning for the integration of the companies is to begin after antitrust clearance, the companies said.

ETE said it does not expect the deal to affect the credit ratings of Energy Transfer Partners, Sunoco Logistics, Sunoco LP or Williams Partners.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |